Delving into Index funds explained, this introduction immerses readers in a unique and compelling narrative, providing an in-depth look at the world of index funds. From their definition to the benefits and risks involved, this guide aims to equip readers with the knowledge needed to make informed investment decisions.

As we explore the intricacies of index funds, readers will gain valuable insights into the world of passive investing and how these funds play a crucial role in building a diversified investment portfolio.

What are index funds?

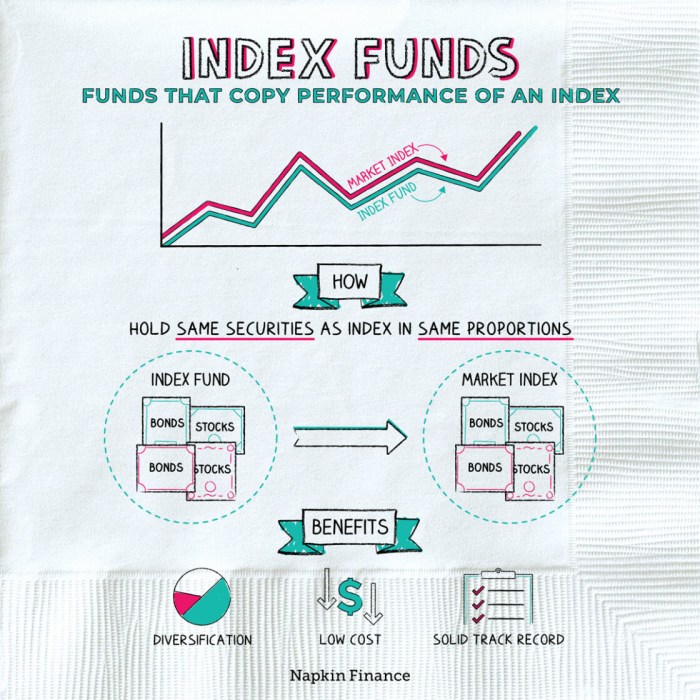

Index funds are a type of investment fund that aims to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, which involve a team of professionals actively buying and selling stocks to outperform the market, index funds follow a passive investing strategy.

Passive investing involves creating a diversified portfolio that mirrors the performance of a particular index rather than trying to beat it. This approach typically results in lower fees and taxes compared to actively managed funds.

Examples of popular index funds

- Vanguard Total Stock Market Index Fund (VTSAX): This fund tracks the performance of the CRSP US Total Market Index, providing exposure to the entire U.S. stock market.

- iShares Core S&P 500 ETF (IVV): This fund aims to replicate the performance of the S&P 500 index, which consists of the 500 largest publicly traded companies in the United States.

- SPDR S&P 500 ETF Trust (SPY): Another option for investors looking to invest in the S&P 500 index, this ETF is one of the oldest and most widely traded funds of its kind.

Benefits of investing in index funds

Index funds offer numerous advantages for investors looking to build a diversified portfolio while keeping costs low. These benefits include:

Diversification and lower fees

Index funds provide exposure to a wide range of assets, such as stocks or bonds, without the need for individual selection. By tracking a specific index, investors can achieve instant diversification across various sectors and industries. Additionally, index funds typically have lower fees compared to actively managed funds, as they require minimal management and research.

Effortless exposure to a wide range of assets

Investing in index funds allows investors to gain exposure to a diversified portfolio of assets with minimal effort. Instead of researching and selecting individual securities, investors can simply invest in an index fund that mirrors the performance of a specific index. This passive approach to investing can save time and reduce the stress of actively managing a portfolio.

Performance comparison with actively managed funds

Studies have shown that index funds tend to outperform actively managed funds over the long term, primarily due to lower fees and consistent performance tracking. Actively managed funds often struggle to beat their benchmarks after accounting for fees, making index funds a more cost-effective and reliable option for many investors.

How to invest in index funds

Investing in index funds can be a straightforward way to build a diversified investment portfolio. Here are the steps to guide you through the process:

Opening a brokerage account

To invest in index funds, you first need to open a brokerage account. Research and choose a reputable brokerage firm that offers a variety of index funds to invest in.

Purchasing index funds

There are different ways to purchase index funds, such as through exchange-traded funds (ETFs) or mutual funds.

- Exchange-Traded Funds (ETFs): ETFs are traded on stock exchanges and can be bought and sold throughout the trading day at market prices. They typically have lower expense ratios compared to mutual funds.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks or bonds. They are priced at the end of the trading day and have expense ratios that can vary.

Setting up automatic investments

Setting up automatic investments in index funds can help you stay disciplined with your investment strategy. You can automate regular contributions from your bank account to your brokerage account, making it easier to consistently invest in index funds over time.

Risks and considerations

Investing in index funds comes with its own set of risks and considerations that investors should be aware of before making decisions. These factors can impact the performance of the investment and the overall return on investment. It is important to understand these risks and considerations to make informed choices when investing in index funds.

Market Volatility

Market volatility is a significant risk associated with investing in index funds. Fluctuations in the stock market can impact the value of the index fund, leading to potential losses for investors. It is essential to be prepared for these fluctuations and have a long-term investment horizon to weather the ups and downs of the market.

Expense Ratios and Fees

Another consideration when choosing an index fund is the expense ratios and fees associated with the investment. High expense ratios can eat into the returns generated by the fund, reducing the overall profitability of the investment. Investors should carefully review and compare the expense ratios of different index funds before making a decision.

Tracking Error

Tracking error is a measure of how closely an index fund follows its benchmark index. A high tracking error can indicate that the fund is not accurately mirroring the performance of the index, leading to deviations in returns. Investors should look for index funds with low tracking error to ensure that their investment closely tracks the performance of the underlying index.

Tips for Mitigating Risks

– Diversify your investments across different asset classes and sectors to reduce risk exposure.

– Regularly review your portfolio and make adjustments based on changes in the market and your investment goals.

– Consider dollar-cost averaging to mitigate the impact of market volatility by investing a fixed amount at regular intervals.

– Stay informed about market trends and economic indicators to make informed investment decisions.