Delving into the realm of Cost of living adjustments, this introductory paragraph aims to provide a detailed overview of this financial concept, shedding light on its significance and implications.

Exploring the intricacies of how Cost of living adjustments impact various aspects of individuals’ financial well-being, this paragraph sets the stage for an informative discussion ahead.

Definition of Cost of Living Adjustments

Cost of Living Adjustments (COLA) refer to changes made to salaries, benefits, or pensions to account for the fluctuations in the cost of living. These adjustments are typically based on the Consumer Price Index (CPI) or other inflation measures and are meant to ensure that individuals can maintain their purchasing power despite rising prices.

Impact on Salaries

- Employers may increase salaries annually based on COLA to keep pace with inflation and ensure employees can afford the same standard of living.

- COLA helps prevent employees’ purchasing power from decreasing over time, especially in high-cost areas where expenses tend to rise.

Impact on Benefits

- Benefit programs such as healthcare coverage or retirement plans may be adjusted using COLA to account for rising costs in these areas.

- By incorporating COLA into benefit calculations, organizations aim to protect the financial well-being of their employees and retirees.

Importance of COLA

- COLA plays a crucial role in maintaining the quality of life for individuals, ensuring that their income levels keep up with the cost of essential goods and services.

- Without COLA, individuals’ purchasing power would erode over time, making it challenging to afford basic necessities and maintain financial stability.

Factors Influencing Cost of Living Adjustments

In determining Cost of Living Adjustments (COLA), several key factors play a crucial role. These factors include inflation rates, consumer price index (CPI), wage growth, and regional variations. Understanding how these factors influence the calculation of COLA is essential for both employers and employees.

Inflation Rates

Inflation rates have a direct impact on the cost of living in a specific area. When prices for goods and services increase, individuals need to spend more to maintain the same standard of living. As inflation rises, COLA adjustments are made to ensure that employees’ purchasing power is not eroded.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a key measure used to track changes in the prices of a basket of goods and services over time. COLA adjustments often rely on the CPI to determine the rate of increase in the cost of living. By analyzing the CPI data, employers can make informed decisions about adjusting wages to keep pace with rising prices.

Wage Growth

Wage growth is another factor that influences COLA calculations. When wages increase, individuals have more disposable income to cover the rising cost of living. Employers may consider wage growth trends when determining the need for COLA adjustments to ensure that employees can afford essential expenses.

Regional Variations

Regional variations in the cost of living can significantly impact COLA calculations. Different areas may experience varying levels of inflation, wage growth, and cost of goods and services. Employers operating in multiple regions need to consider these differences when implementing COLA adjustments to account for the specific cost of living challenges faced by employees in each location.

How Cost of Living Adjustments are Calculated

Cost of Living Adjustments (COLA) are calculated using a specific formula or method to ensure that the adjustments accurately reflect changes in the cost of goods and services over time. Various organizations and governments have their own approaches to calculating COLA, which can lead to differences in adjustment amounts. However, the general concept revolves around measuring inflation and adjusting income or benefits accordingly.

Formula for Calculating COLA

In general, the formula for calculating Cost of Living Adjustments involves comparing the Consumer Price Index (CPI) or other inflation indicators from one period to another. The basic formula can be expressed as:

COLA = (Current CPI – Previous CPI) / Previous CPI

This formula calculates the percentage change in the CPI between two time periods, which is then applied to income or benefits to adjust for inflation.

Examples of COLA Calculation Methods

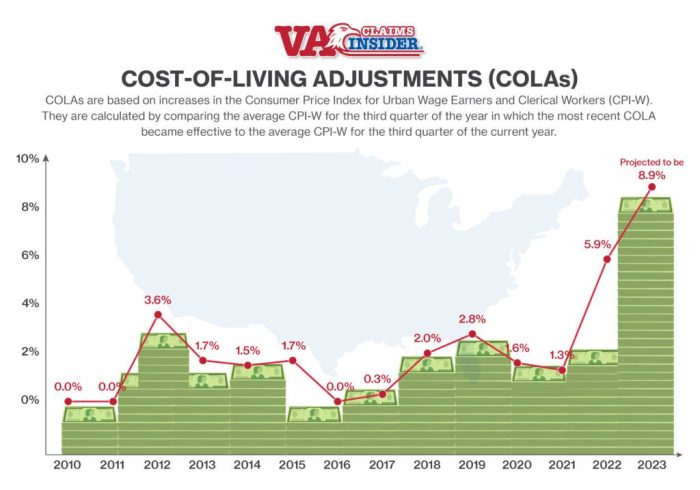

- United States: The Social Security Administration uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to calculate COLA for Social Security benefits.

- European Union: The European Central Bank considers the Harmonized Index of Consumer Prices (HICP) to determine adjustments for Eurozone countries.

- Private Companies: Some employers use the CPI-U (Consumer Price Index for All Urban Consumers) to calculate COLA for employee salaries.

Challenges and Criticisms

- Accuracy Concerns: Some critics argue that the CPI may not fully reflect the true cost of living for all individuals, leading to inaccuracies in COLA calculations.

- Regional Variations: Different regions may experience varying inflation rates, making a standardized COLA calculation challenging for diverse populations.

- Weighting Issues: The weights assigned to different categories in the CPI may not align with individual spending patterns, affecting the relevance of COLA adjustments.

Impact of Cost of Living Adjustments on Individuals

Cost of Living Adjustments (COLA) directly influences the standard of living for individuals, affecting their financial stability and overall quality of life.

Illustration of Impact on Budgeting and Financial Planning

Cost of Living Adjustments can impact individuals’ budgeting and financial planning in various ways:

- Increased Expenses: Rising costs due to inflation can lead to higher expenses for necessities such as food, housing, and healthcare.

- Income Adjustments: COLA may result in adjustments to income levels, impacting budget allocations for savings, investments, and discretionary spending.

- Debt Management: Changes in cost of living can affect debt repayment strategies, requiring individuals to reassess their financial obligations.

Strategies to Cope with Changes in Cost of Living Adjustments

Individuals can employ the following strategies to cope with fluctuations in cost of living adjustments:

- Regular Budget Reviews: Conducting frequent reviews of expenses and income to identify areas for adjustment and optimization.

- Emergency Savings Fund: Building an emergency fund to cushion against unexpected expenses or income fluctuations caused by COLA changes.

- Seeking Additional Income: Exploring opportunities for supplemental income through part-time work or side hustles to offset rising costs.

- Adapting Spending Habits: Making conscious choices to prioritize essential expenses and cut back on non-essential purchases to adapt to changing financial circumstances.