Delving into How to read financial statements, this introduction immerses readers in a unique and compelling narrative, providing a detailed overview of financial statements and their significance in the world of investments and analysis. Understanding financial statements is not only essential for investors but also crucial for analysts and stakeholders seeking to make informed decisions based on financial data. By unraveling the complexities of financial statements, individuals can gain valuable insights into the financial health and performance of a company.

Introduction to Financial Statements

Financial statements are essential documents that provide insight into the financial performance and position of a company. They are used by investors, analysts, creditors, and other stakeholders to evaluate the financial health and make informed decisions.

Purpose of Financial Statements

Financial statements serve the purpose of presenting the financial information of a company in a structured manner. They provide a snapshot of the company’s financial performance, position, and cash flow, allowing stakeholders to assess profitability, liquidity, solvency, and overall financial stability.

- Income Statement: Shows the company’s revenue, expenses, and net income over a specific period.

- Balance Sheet: Presents the company’s assets, liabilities, and shareholders’ equity at a specific point in time.

- Cash Flow Statement: Details the inflow and outflow of cash and cash equivalents during a specific period.

Key Components of Financial Statements

Financial statements consist of three main components: the income statement, balance sheet, and cash flow statement. Each component provides valuable information that, when analyzed collectively, gives a comprehensive view of the company’s financial performance and position.

Understanding financial statements is crucial for investors, analysts, and stakeholders as it helps them make informed decisions, assess the company’s financial health, and identify potential risks and opportunities.

Types of Financial Statements

Financial statements are crucial tools for investors, creditors, and other stakeholders to evaluate the financial health and performance of a company. The main types of financial statements include the Income Statement, Balance Sheet, and Cash Flow Statement. Each of these statements provides specific information essential for making informed decisions about the company’s operations and financial status.

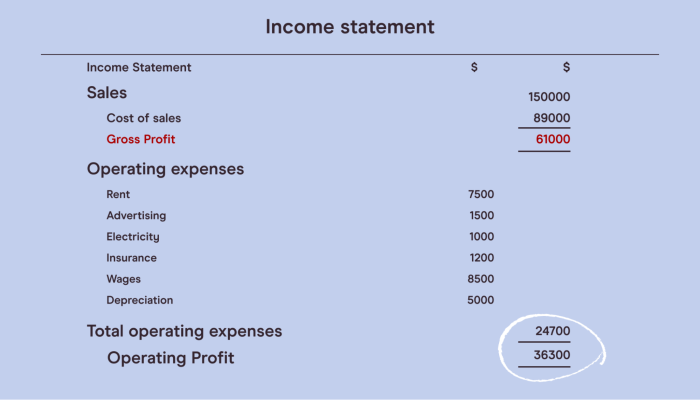

Income Statement

The Income Statement, also known as the Profit and Loss Statement, presents the company’s revenues, expenses, and net income or loss over a specific period. It provides insights into the company’s profitability by showing how much money the business has generated and how much it has spent to earn that revenue. The Income Statement helps in assessing the company’s ability to generate profits from its core operations.

Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a specific point in time. It consists of three main components: assets, liabilities, and shareholders’ equity. Assets represent what the company owns, liabilities are what it owes, and shareholders’ equity is the difference between the two. The Balance Sheet helps in understanding the company’s financial strength, liquidity, and solvency.

Cash Flow Statement

The Cash Flow Statement shows how changes in balance sheet accounts and income affect cash and cash equivalents. It is divided into three main sections: operating activities, investing activities, and financing activities. The Cash Flow Statement helps in assessing the company’s ability to generate cash and its liquidity position. It also provides insights into how the company is using cash to fund its operations, investments, and financing activities.

Reading an Income Statement

Income statements provide a snapshot of a company’s financial performance by showing its revenue and expenses over a specific period. Analyzing an income statement can help investors, analysts, and other stakeholders understand how profitable a company is.

Analyzing Revenue and Expenses

Income statements typically start with revenue at the top, followed by various expenses. Revenue represents the total amount of money earned from selling goods or services. Expenses, on the other hand, are the costs incurred to generate that revenue. By comparing revenue to expenses, you can determine if a company is making a profit or a loss.

- Common Line Items on an Income Statement:

- 1. Revenue: Sales income generated from selling goods or services.

- 2. Cost of Goods Sold (COGS): Direct costs associated with producing goods or services.

- 3. Gross Profit: Revenue minus COGS, indicating the profitability of core operations.

- 4. Operating Expenses: Costs related to running the business, such as salaries, rent, and utilities.

- 5. Net Income: The final profit or loss after deducting all expenses from revenue.

Calculating Profitability Ratios

Profitability ratios help assess a company’s ability to generate profit relative to its revenue, assets, or equity. Common ratios based on income statement data include gross margin, operating margin, and net margin.

- Gross Margin = (Revenue – COGS) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

Understanding a Balance Sheet

When analyzing a company’s financial health, one of the key documents to review is the balance sheet. This financial statement provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Assets, Liabilities, and Equity Sections

- Assets: This section lists all the resources owned by the company, such as cash, inventory, property, and equipment. Assets are typically classified as current (short-term) or non-current (long-term).

- Liabilities: Liabilities represent the company’s obligations or debts, including accounts payable, loans, and other financial responsibilities. Like assets, liabilities are categorized as current or non-current.

- Equity: Equity shows the company’s net worth and is calculated as assets minus liabilities. It includes common stock, retained earnings, and other equity components.

Assessing Financial Health

The balance sheet helps investors and analysts evaluate a company’s financial position. By comparing assets to liabilities, one can determine the company’s solvency and ability to meet its financial obligations. Additionally, examining changes in equity over time can indicate profitability and overall financial performance.

Sample Balance Sheet

| Amount | |

|---|---|

| Assets | |

| Cash | $100,000 |

| Inventory | $50,000 |

| Total Assets | $150,000 |

| Liabilities | |

| Accounts Payable | $30,000 |

| Loans Payable | $20,000 |

| Total Liabilities | $50,000 |

| Equity | |

| Common Stock | $70,000 |

| Retained Earnings | $30,000 |

| Total Equity | $100,000 |

Interpreting a Cash Flow Statement

Cash flow analysis is a crucial aspect of financial statement analysis for businesses as it provides insights into how cash is being generated and used within a company. Understanding a cash flow statement helps investors, creditors, and management assess the financial health and stability of a business.

Importance of Cash Flow Analysis

Interpreting a cash flow statement allows stakeholders to evaluate a company’s ability to generate cash to cover operating expenses, invest in growth opportunities, and meet debt obligations. It provides a more accurate picture of a company’s liquidity compared to the income statement or balance sheet.

Main Sections of a Cash Flow Statement

A cash flow statement typically consists of three main sections:

- Operating Activities: This section includes cash flows from the primary business operations of the company, such as revenue and expenses.

- Investing Activities: This section covers cash flows related to the acquisition and disposal of long-term assets, such as property, plant, and equipment.

- Financing Activities: This section includes cash flows from activities like issuing or repurchasing stock, borrowing or repaying debt, and paying dividends.

Real-World Example of Cash Flow Analysis

For example, a company with positive operating cash flows but negative investing and financing cash flows may indicate that the company is generating enough cash from its core operations but is investing heavily in assets or paying off debt. This could suggest a focus on long-term growth and expansion, which may be viewed positively by investors looking for a company with a strategic investment approach.