Delving into the realm of Insurance policy comparisons sheds light on the essential practice of evaluating different policies to make well-informed decisions. By understanding the nuances of policy variations, individuals can secure the most suitable coverage tailored to their specific needs and potentially save on costs.

As we navigate through the intricacies of comparing insurance policies, we unravel key insights and considerations that play a pivotal role in selecting the optimal coverage.

Importance of Insurance Policy Comparisons

When it comes to safeguarding your financial well-being, comparing insurance policies is a crucial step in making informed decisions. By analyzing different policy options, individuals can ensure they find the best coverage that meets their specific needs and offers the most value for their money.

Finding the Best Coverage

Policy comparisons allow individuals to evaluate the various features, benefits, and exclusions of different insurance plans. This process helps in identifying the policy that provides the most comprehensive coverage for specific risks or circumstances. For example, comparing health insurance policies can help individuals choose a plan that covers their required medical treatments and services at an affordable cost.

Saving Money

One of the significant advantages of comparing insurance policies is the potential for saving money. By shopping around and comparing premiums, deductibles, and coverage limits, individuals can find cost-effective options that offer the same level of protection. For instance, comparing auto insurance policies from different providers can help consumers identify discounts and special offers that can significantly reduce their premiums.

Factors to Consider When Comparing Insurance Policies

When comparing insurance policies, it is crucial to take into account several key factors that can significantly impact your coverage and financial well-being. Understanding the differences in coverage limits, deductibles, premiums, and exclusions among various policies is essential to making an informed decision. Additionally, evaluating policy features such as additional benefits, riders, and endorsements can provide you with a more comprehensive understanding of the protection offered by each policy. Lastly, assessing the financial stability and reputation of insurance companies can help ensure that you choose a reliable provider that will be there for you when you need to file a claim.

Coverage Limits, Deductibles, Premiums, and Exclusions

- Coverage Limits: Compare the maximum amount an insurance policy will pay out for a covered claim.

- Deductibles: Consider the amount you will have to pay out of pocket before your insurance coverage kicks in.

- Premiums: Compare the cost of premiums for each policy to ensure you are getting the best value for your money.

- Exclusions: Be aware of any specific events or circumstances that are not covered by the policy.

Policy Features: Additional Benefits, Riders, and Endorsements

- Additional Benefits: Look for any extra perks or services included in the policy that may enhance your coverage.

- Riders: Evaluate optional add-ons that can customize your policy to better suit your needs.

- Endorsements: Consider any modifications or changes to the standard policy language that may affect your coverage.

Financial Stability and Reputation of Insurance Companies

- Financial Stability: Research the financial strength of insurance companies by checking their ratings from independent agencies like A.M. Best, Moody’s, or Standard & Poor’s.

- Reputation: Look into customer reviews, complaints, and testimonials to gauge the overall satisfaction and reliability of the insurance company.

Types of Insurance Policies to Compare

When comparing insurance policies, individuals commonly evaluate various types of insurance coverage to ensure they are adequately protected in different aspects of their lives. It is crucial to understand the unique considerations for each type of insurance policy to make informed decisions.

Auto Insurance

Auto insurance policies are designed to provide financial protection against physical damage and bodily injury resulting from traffic collisions and other incidents. When comparing auto insurance policies, individuals should consider factors such as coverage limits, deductibles, discounts, and additional coverage options like roadside assistance and rental car reimbursement.

Home Insurance

Home insurance policies offer coverage for damage to one’s home and personal belongings, as well as liability protection in case someone is injured on the property. When evaluating home insurance policies, individuals should review the coverage limits for dwelling, personal property, and liability, as well as additional coverage options for natural disasters, theft, and personal injury.

Health Insurance

Health insurance policies provide coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and preventive care. When comparing health insurance policies, individuals should consider factors such as premiums, deductibles, copayments, network coverage, and coverage for pre-existing conditions. It is essential to assess the level of coverage needed based on individual health needs and budget.

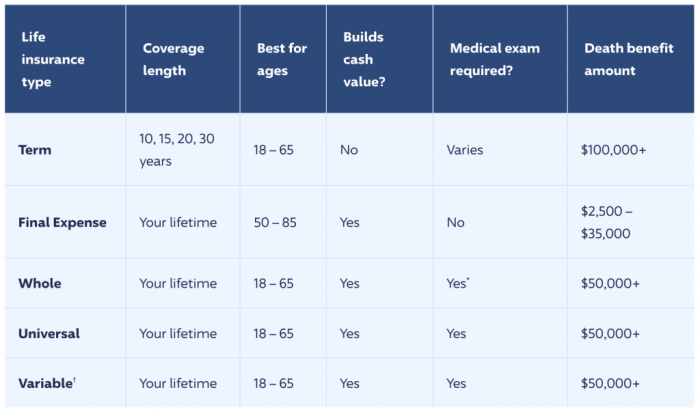

Life Insurance

Life insurance policies offer financial protection for beneficiaries in the event of the policyholder’s death. When evaluating life insurance policies, individuals should consider factors such as the type of policy (term life or whole life), coverage amount, premiums, riders for additional coverage options, and the financial stability of the insurance company. It is important to assess the long-term financial needs of dependents and loved ones when choosing a life insurance policy.

Bundle Policies

Bundling insurance policies from the same insurer can be advantageous for consumers in terms of convenience, cost savings, and potential discounts. By combining multiple policies, such as auto and home insurance, with the same insurer, individuals may qualify for a multi-policy discount and have the convenience of managing all their insurance needs with one company. However, it is essential to compare the bundled rate with individual policies from different insurers to ensure the best overall value and coverage for each type of insurance needed.

Tools and Resources for Comparing Insurance Policies

When it comes to comparing insurance policies, there are various tools and resources available to help individuals make informed decisions. These tools can range from online comparison platforms to the expertise of insurance agents or brokers.

Online Comparison Tools

Online comparison tools are websites or platforms that allow users to input their information and preferences to receive side-by-side comparisons of different insurance policies. These tools can help individuals quickly and easily see the differences in coverage, premiums, and other important details.

- One popular online comparison tool is Policygenius, which offers comparisons for various types of insurance such as life, health, and auto insurance.

- Another well-known platform is Compare.com, which specializes in comparing auto insurance policies from different providers.

Role of Insurance Agents or Brokers

Insurance agents or brokers can also play a crucial role in helping individuals compare and choose insurance policies. These professionals have a deep understanding of the insurance market and can provide personalized recommendations based on a client’s needs and budget.

Insurance agents can offer valuable insights and guidance to navigate the complexities of insurance policies and make well-informed decisions.

Effective Use of Comparison Websites

When using comparison websites, it is important to follow a systematic approach to gather and analyze policy information effectively. Here are some tips:

- Start by entering accurate and up-to-date information about yourself and your insurance needs.

- Compare policies based on coverage limits, deductibles, exclusions, and premium costs.

- Read the fine print and understand the terms and conditions of each policy before making a decision.

- Consider seeking advice from an insurance agent or broker for a more personalized recommendation.