When it comes to 401(k) vs. IRA, get ready to dive into the world of retirement savings with a twist of American high school hip style. This article promises a fresh take on the comparison, making sure you’re in for an informative and fun read.

In the following paragraphs, we’ll break down the benefits, contribution limits, investment options, and withdrawal rules of both 401(k) and IRA accounts.

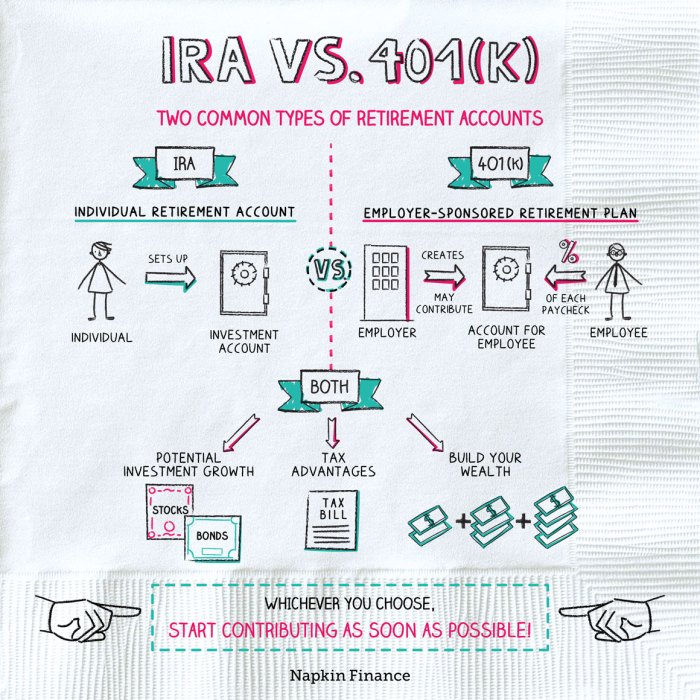

Benefits of 401(k) and IRA

Saving for retirement is crucial, and both 401(k) and IRA accounts offer unique advantages to help you grow your nest egg. Let’s dive into the benefits of each option.

Tax Advantages of 401(k) Contributions

When you contribute to a 401(k) account, you can enjoy immediate tax benefits. The money you contribute is typically deducted from your taxable income, which means you pay less in income tax for the year. This can lower your overall tax bill, allowing you to keep more of your hard-earned money in your pocket.

Tax Benefits of IRA Contributions

Contributing to an IRA can also provide tax advantages by reducing your taxable income. Depending on the type of IRA you have, you may be able to deduct your contributions from your taxable income, similar to a 401(k). This can help lower your tax liability and increase your retirement savings over time.

Employer Match Benefits

One major advantage of a 401(k) is the potential for employer matching contributions. Some employers offer to match a portion of your contributions, effectively giving you free money to boost your retirement savings. This employer match is essentially a bonus on top of your own contributions, helping your retirement fund grow even faster.

Differences in Contribution Limits

When it comes to saving for retirement, understanding the contribution limits for 401(k) plans and IRAs is crucial. Let’s break down how these limits differ and what they mean for your retirement savings.

401(k) Contribution Limits

For 2021, the annual contribution limit for 401(k) plans is $19,500 for individuals under 50. This means you can contribute up to $19,500 per year from your pre-tax income to your 401(k) account to help build your retirement savings.

IRA Contribution Limits

On the other hand, IRA contribution limits are different from 401(k) limits. For 2021, the annual contribution limit for IRAs is $6,000 for individuals under 50. This includes both Traditional and Roth IRAs. This means you can contribute up to $6,000 per year to your IRA account to save for retirement.

Catch-Up Contributions

Individuals aged 50 and above have the option to make catch-up contributions to boost their retirement savings. For 401(k) plans, the catch-up contribution limit for 2021 is an additional $6,500, making the total contribution limit $26,000 for those 50 and older. For IRAs, the catch-up contribution limit is an additional $1,000, bringing the total contribution limit to $7,000 for individuals aged 50 and above.

Now that you understand the differences in contribution limits between 401(k) plans and IRAs, you can make informed decisions about how to maximize your retirement savings potential.

Investment Options

When it comes to investment options, both 401(k) plans and IRAs offer a variety of choices for individuals looking to grow their retirement savings. However, there are some key differences in the investment options available in each type of account.

401(k) plans typically offer a selection of mutual funds, stocks, bonds, and other investment vehicles curated by the employer or plan administrator. This means that employees have limited control over the specific investments in their 401(k) and must choose from the options provided by the plan.

Investment Choices in 401(k) Plan

In a 401(k) plan, employees often have access to a range of mutual funds with different risk profiles, such as target-date funds, index funds, and actively managed funds. Additionally, some plans may offer company stock as an investment option. This can provide diversification within the plan, but the choices are typically curated by the employer.

Flexibility of Investment Options in IRA

On the other hand, IRAs offer much more flexibility when it comes to investment options. With an IRA, individuals can choose from a wide range of investment vehicles, including individual stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and more. This flexibility allows investors to tailor their investment strategy to their specific financial goals and risk tolerance.

Investment Diversification in 401(k) vs. IRA

While both 401(k) plans and IRAs allow for investment diversification, the level of control and customization differs between the two. In a 401(k) plan, employees are limited to the investment options provided by the plan, which may not always align perfectly with their individual financial goals. On the other hand, IRAs offer greater control and flexibility, allowing investors to build a diversified portfolio that reflects their unique investment strategy.

Withdrawal Rules and Penalties

When it comes to accessing your retirement savings early, both 401(k) and IRA accounts have specific rules and penalties in place. Let’s dive into the details.

Penalties for Early 401(k) Withdrawal

Early withdrawal from a 401(k) before the age of 59½ typically incurs a 10% penalty on the withdrawn amount, on top of any applicable income taxes. This penalty is in addition to the regular income tax you’ll owe on the withdrawn funds.

Withdrawal Rules for Traditional and Roth IRAs

For traditional IRAs, withdrawals before the age of 59½ usually result in a 10% penalty, along with income tax on the withdrawn amount. However, there are some exceptions, such as using the funds for qualified higher education expenses or a first-time home purchase.

On the other hand, Roth IRAs allow penalty-free withdrawals of contributions at any time, since the contributions were made with after-tax money. Earnings may be subject to penalties if withdrawn early.

Comparison of Penalties between 401(k) and IRA

In general, the penalties for early withdrawal from a 401(k) are more severe compared to those for an IRA. While both accounts may incur a 10% penalty for withdrawals before retirement age, the tax implications and exceptions vary between a 401(k) and an IRA.