Starting with Passive Income Ideas, let’s dive into the world of financial independence and explore various ways to make money while you sleep. Whether you’re interested in real estate, online ventures, or investments, this guide has got you covered.

Types of Passive Income

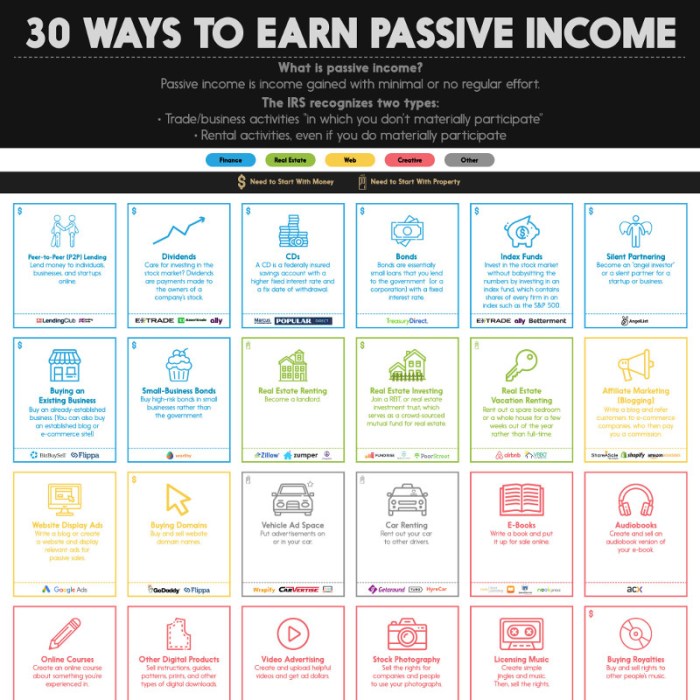

Passive income is money earned with little to no effort required to maintain it. It is a great way to generate additional income streams without having to actively work for it. There are various types of passive income streams that individuals can explore to build wealth over time.

1. Rental Income

Rental income is earned by leasing out properties to tenants. Landlords collect rent payments on a regular basis, providing a steady income stream. This type of passive income requires initial investment in purchasing properties, maintaining them, and managing tenant relationships. Popular examples include renting out residential homes, commercial spaces, or vacation rentals.

2. Dividend Income

Dividend income is earned by investing in stocks that pay dividends to shareholders. Companies distribute a portion of their profits to investors as dividends, providing a passive income source. Investors can choose dividend-paying stocks from various sectors such as utilities, consumer goods, or technology. Examples include blue-chip companies like Coca-Cola, Apple, or Johnson & Johnson.

3. Interest Income

Interest income is earned by lending money to borrowers who pay interest on the loan amount. This can be in the form of bonds, peer-to-peer lending platforms, or high-yield savings accounts. Investors earn passive income through the interest payments received on their investments. Examples include Treasury bonds, corporate bonds, or certificates of deposit (CDs).

4. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral link. This passive income stream can be generated through blogs, social media platforms, or email marketing campaigns. Affiliates partner with companies to promote their products and earn a percentage of the sales revenue. Examples include Amazon Associates, ClickBank, or ShareASale.

5. Royalties

Royalties are payments received for the use of intellectual property, such as books, music, or patents. Creators earn passive income through royalties whenever their work is reproduced or licensed to third parties. This type of passive income requires creating original content or inventions that can be monetized over time. Examples include bestselling authors, musicians, or inventors who receive royalties for their creations.

Real Estate Passive Income

Generating passive income through real estate involves investing in properties that generate revenue without active involvement on a daily basis. One popular method is through rental properties, where tenants pay rent to the property owner.

Rental Properties

Rental properties are real estate investments that are leased out to tenants in exchange for regular rental income. This type of passive income requires initial investment in purchasing the property, but ongoing management can be outsourced to property management companies.

- Ensure the property is in a desirable location with high rental demand.

- Screen potential tenants carefully to avoid issues with late payments or property damage.

- Maintain the property well to retain tenants and increase property value over time.

Long-term Rentals vs. Short-term Vacation Rentals

Long-term rentals involve leasing properties to tenants on a yearly basis, providing stable and consistent rental income. On the other hand, short-term vacation rentals, such as Airbnb, offer higher rental rates but require more active management and maintenance.

- Long-term rentals are suitable for investors seeking stable, long-term income streams.

- Short-term vacation rentals can be lucrative during peak tourist seasons but may have higher turnover and maintenance costs.

- Consider local regulations and zoning laws when choosing between long-term and short-term rentals.

Tips for Successful Real Estate Investing

Successful real estate investing requires careful planning, research, and ongoing management to maximize passive income potential.

- Diversify your real estate portfolio to reduce risk and maximize income potential.

- Stay informed about local real estate market trends and rental demand in different neighborhoods.

- Work with experienced real estate professionals, such as agents and property managers, to navigate the market effectively.

Online Passive Income

In today’s digital age, there are various opportunities to generate passive income online. Whether through affiliate marketing or creating and selling digital products, the internet offers endless possibilities for building a successful online business that can bring in passive income streams.

Affiliate Marketing

Affiliate marketing is a popular way to earn passive income online by promoting products or services from other companies. As an affiliate, you earn a commission for every sale or lead generated through your unique affiliate link. By strategically choosing the right products or services to promote and reaching the target audience effectively, you can generate a steady stream of passive income.

Creating and Selling Digital Products, Passive Income Ideas

Another lucrative option for online passive income is creating and selling digital products such as e-books, online courses, stock photos, or software. Once you have created the product, you can set up automated sales funnels or platforms to sell them, allowing you to earn passive income continuously without much ongoing effort.

Tips for Building a Successful Online Business for Passive Income

- Identify a niche with high demand and low competition to maximize your earning potential.

- Invest time and effort in creating quality content or products that provide value to your audience.

- Utilize effective digital marketing strategies such as , social media marketing, and email marketing to reach a wider audience.

- Focus on building a strong brand and establishing credibility in your niche to attract loyal customers.

- Regularly analyze and optimize your online business to adapt to changing market trends and consumer preferences.

Investment Passive Income: Passive Income Ideas

Investment passive income involves earning money from investments with minimal effort on your part. This can be achieved through various investment vehicles that generate regular income without active involvement.

Dividend Stocks

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. Investors can earn passive income by holding onto these stocks and receiving regular dividend payments.

- Dividends are typically paid quarterly or annually, providing a steady stream of income.

- Investors can reinvest dividends to purchase more shares, compounding their returns over time.

- Choosing dividend stocks from stable and profitable companies can help ensure a reliable income stream.

Index Funds, Bonds, and REITs

Investors can also generate passive income through other investment vehicles such as index funds, bonds, and Real Estate Investment Trusts (REITs).

- Index funds offer diversification by tracking a specific market index, reducing individual stock risk.

- Bonds provide fixed income payments at regular intervals, making them a stable source of passive income.

- REITs allow investors to earn rental income from real estate properties without the hassle of property management.

Diversified Investment Portfolio

Building a diversified investment portfolio is crucial for generating passive income and reducing risk.

- Spread investments across different asset classes to minimize the impact of market fluctuations.

- Regularly review and rebalance your portfolio to ensure it aligns with your financial goals and risk tolerance.

- Consider consulting with a financial advisor to develop a customized investment strategy tailored to your specific needs.