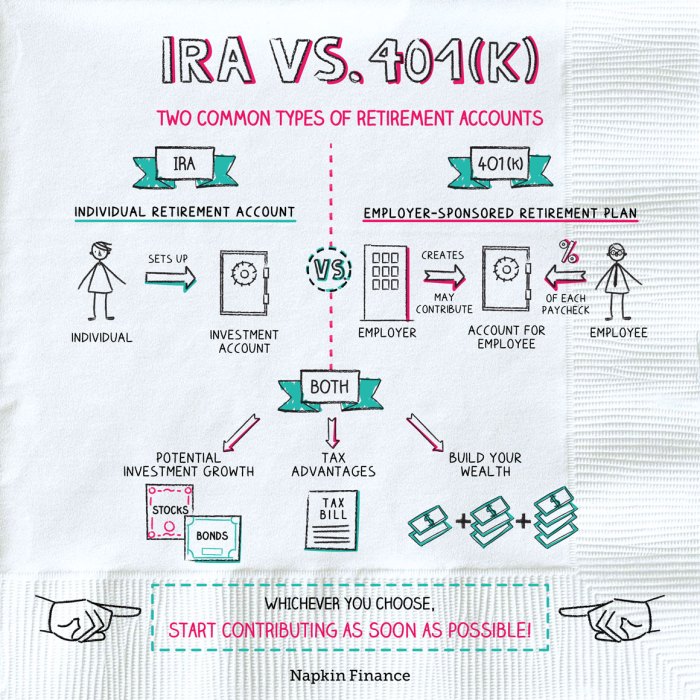

Exploring the differences between 401(k) and IRA can provide valuable insights for individuals planning for retirement. This comparison delves into key aspects of each retirement account, offering a detailed analysis to help individuals make informed decisions regarding their financial future.

401(k) vs. IRA Basics

401(k) and IRA are both popular retirement savings options in the United States. While they serve the same purpose of helping individuals save for retirement, there are key differences between the two.

A 401(k) is an employer-sponsored retirement account, where contributions are made directly from your paycheck before taxes are taken out. Employers often match a portion of the employee’s contributions, providing a valuable incentive to save for retirement. The funds in a 401(k) are typically invested in a selection of mutual funds or other investment options chosen by the employer.

On the other hand, an Individual Retirement Account (IRA) is a retirement account that an individual can open on their own through a financial institution. Contributions to a traditional IRA are made with pre-tax dollars, while contributions to a Roth IRA are made with after-tax dollars. The individual has more control over the investment choices within an IRA compared to a 401(k).

Key Differences

- A 401(k) is an employer-sponsored retirement account, while an IRA is opened by an individual through a financial institution.

- Contributions to a 401(k) are often matched by the employer, providing additional savings, whereas contributions to an IRA are made by the individual.

- 401(k) contributions are made with pre-tax dollars, while IRA contributions can be made with pre-tax (traditional IRA) or after-tax (Roth IRA) dollars.

Main Features

- 401(k): Employer-sponsored, often includes employer matching contributions, limited investment options chosen by the employer.

- IRA: Individual retirement account, more control over investment choices, can be traditional or Roth with different tax treatment.

Eligibility Criteria

- 401(k): Generally available to employees of companies offering the plan, may have eligibility requirements such as a minimum age or length of service.

- IRA: Open to individuals meeting income limits, anyone with earned income can contribute, with different rules for traditional and Roth IRAs.

- Employer matching is essentially free money added to the employee’s retirement savings.

- It incentivizes employees to save for retirement and helps them grow their retirement nest egg faster.

- Employer matching contributions are subject to vesting schedules, which determine when the employee gains full ownership of the employer-contributed funds.

- Individuals have more control over their IRA contributions and investment choices compared to 401(k) plans with employer matching.

- Employer matching is a unique feature of 401(k) plans that can significantly boost retirement savings over time.

- Contributions are made on a pre-tax basis, reducing taxable income

- Investment earnings grow tax-deferred until withdrawal

- Lower tax liability in the current year

- Contributions are made with after-tax dollars

- Investment earnings grow tax-deferred until withdrawal

- No immediate tax deduction for contributions

- 401(k) withdrawals taxed as ordinary income

- Traditional IRA withdrawals taxed as ordinary income

- Roth IRA withdrawals are tax-free in retirement

Contribution Limits

401(k)s and IRAs have specific contribution limits set by the Internal Revenue Service (IRS) to regulate the amount of money individuals can save for retirement in a tax-advantaged manner. These limits are subject to change each year based on inflation adjustments.

401(k) Contribution Limits

401(k) plans have higher contribution limits compared to IRAs. For 2021, the contribution limit for 401(k) accounts is $19,500 for individuals under the age of 50. However, individuals aged 50 and above are eligible for catch-up contributions, allowing them to contribute an additional $6,500, bringing the total limit to $26,000.

IRA Contribution Limits

For Traditional and Roth IRAs, the contribution limit for 2021 is $6,000 for individuals under 50 years old. Similar to 401(k)s, individuals aged 50 and above can make catch-up contributions of an extra $1,000, making the total limit $7,000.

Variations in Contribution Limits

It’s essential to note that these contribution limits can change annually, so it’s crucial to stay updated with the current limits. Additionally, factors like income level, filing status, and participation in employer-sponsored retirement plans can affect the amount individuals are allowed to contribute to their 401(k) or IRA accounts.

Employer Matching

Employer matching is a benefit offered by some employers as part of their 401(k) plans. It is a contribution made by the employer to an employee’s retirement account based on the employee’s own contributions.

401(k) Employer Matching

In a 401(k) plan with employer matching, the employer will match a percentage of the employee’s contributions, up to a certain limit. For example, a common matching scenario is a 50% match on the first 6% of the employee’s salary contributed to the 401(k) plan. This means if an employee contributes 6% of their salary, the employer will contribute an additional 3%.

Contrast with IRAs

Unlike 401(k) plans, IRAs do not have employer matching. IRA contributions are made solely by the individual account holder, without any additional contributions from an employer.

Impact on Retirement Savings

Employer matching can have a substantial impact on an individual’s retirement savings. By taking advantage of employer matching contributions, employees can accelerate the growth of their retirement funds and potentially retire with a larger nest egg.

Maximizing employer matching in a 401(k) plan is a smart strategy to make the most of available retirement benefits.

Investment Options

When it comes to investment options, both 401(k) plans and IRAs offer a range of choices for account holders to grow their retirement savings. However, there are differences in the investment choices and flexibility between the two accounts.

Investment Options in a 401(k) Plan

In a 401(k) plan, investment options are typically limited to a selection of mutual funds, target-date funds, and possibly company stock. These funds are chosen by the plan sponsor or administrator, and account holders can allocate their contributions among these options based on their risk tolerance and investment goals.

Investment Choices in an IRA

On the other hand, IRAs provide account holders with a broader range of investment choices compared to 401(k) plans. With an IRA, individuals have the flexibility to invest in a variety of options, including stocks, bonds, mutual funds, ETFs, and even alternative investments like real estate or precious metals. This greater diversity of investment options allows for more customization and control over one’s retirement portfolio.

Differences in Investment Flexibility

The key difference in investment flexibility between a 401(k) plan and an IRA lies in the level of control account holders have over their investments. While 401(k) plans offer a limited selection of pre-approved investment options, IRAs provide individuals with the freedom to choose from a wider array of investment vehicles. This flexibility can be advantageous for those looking to tailor their investments to their specific financial goals and risk tolerance.

Tax Treatment

When it comes to retirement savings, understanding the tax treatment of 401(k) plans and IRAs is crucial for maximizing your savings potential and minimizing tax liabilities. Both 401(k) plans and IRAs offer tax advantages, but the specific benefits differ between the two.

401(k) plans are employer-sponsored retirement accounts that allow employees to contribute a portion of their pre-tax income towards retirement savings. One of the key tax advantages of contributing to a 401(k) plan is that the contributions are made on a pre-tax basis, meaning that the amount you contribute is deducted from your taxable income for the year. This can lower your overall tax liability and allow your retirement savings to grow tax-deferred until withdrawal.

Tax advantages of contributing to a 401(k) plan

On the other hand, contributions to a Traditional IRA are made with after-tax dollars, meaning that you do not get an immediate tax deduction for your contributions. However, the contributions and any earnings in the account grow tax-deferred until withdrawal. This can provide a tax benefit in the long run as your investments can compound without being subject to annual taxes on gains.

Tax implications of contributing to an IRA

When it comes to withdrawals, both 401(k) plans and IRAs have different tax implications. Withdrawals from a 401(k) plan are taxed as ordinary income, regardless of how the contributions were originally made. On the other hand, withdrawals from a Traditional IRA are also taxed as ordinary income, as the contributions were made with after-tax dollars. However, contributions to a Roth IRA are made with after-tax dollars, allowing for tax-free withdrawals of both contributions and earnings in retirement.