401(k) withdrawal penalties set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As individuals navigate the complexities of retirement planning, the repercussions of premature withdrawals loom large, underscoring the necessity of a thorough comprehension of these penalties.

Delving into the nuances of 401(k) withdrawal penalties sheds light on the intricate web of financial implications that individuals must navigate, making informed decisions a cornerstone of successful retirement planning.

Overview of 401(k) Withdrawal Penalties

When it comes to 401(k) accounts, it is essential to understand the potential penalties that may be incurred when making early withdrawals. These penalties are put in place to discourage individuals from tapping into their retirement savings before reaching the eligible age for penalty-free withdrawals.

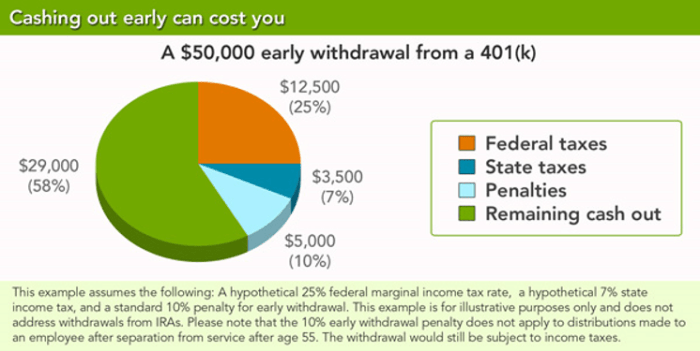

401(k) withdrawal penalties can vary depending on the specific circumstances of the withdrawal. For example, if an individual decides to withdraw funds from their 401(k) before the age of 59 ½, they may be subject to an early withdrawal penalty of 10% in addition to income taxes on the withdrawn amount. This can significantly reduce the amount of money available for retirement and hinder long-term financial goals.

It is crucial for individuals to be aware of these penalties and consider them carefully before making any withdrawals from their 401(k) accounts. By understanding the potential consequences of early withdrawals, individuals can make informed decisions about their retirement savings and ensure they are adequately prepared for the future.

Examples of Situations with Withdrawal Penalties

- Withdrawing funds before the age of 59 ½

- Using the money for non-qualified expenses

- Not rolling over the withdrawn amount within the specified time frame

Types of 401(k) Withdrawal Penalties

Early withdrawals from a 401(k) account can incur various penalties, depending on the type of plan and the circumstances surrounding the withdrawal. It is essential to understand these penalties to make informed decisions regarding your retirement savings.

Penalties for Traditional 401(k) Plans

- Early Withdrawal Penalty: If you withdraw funds from a traditional 401(k) account before the age of 59 ½, you may be subject to a 10% early withdrawal penalty on top of the regular income tax.

- Income Tax: In addition to the early withdrawal penalty, any amount withdrawn from a traditional 401(k) is subject to income tax at your current tax rate.

Penalties for Roth 401(k) Plans

- No Early Withdrawal Penalty: Roth 401(k) plans allow for penalty-free withdrawals of contributions at any time. However, earnings on those contributions may be subject to penalties if withdrawn before age 59 ½.

- Income Tax: Unlike traditional 401(k) plans, withdrawals from Roth 401(k) accounts are typically tax-free as long as certain conditions are met.

Variations in Penalties Based on Age and Circumstances

- Age-Based Penalties: The age of the account holder at the time of withdrawal plays a significant role in determining the penalties. Those under 59 ½ generally face penalties for early withdrawals, while those over this age may be exempt.

- Exceptions: Certain circumstances, such as disability, medical expenses, or first-time home purchases, may qualify for penalty-free withdrawals from a 401(k) account, regardless of age.

Exceptions to 401(k) Withdrawal Penalties

When it comes to 401(k) withdrawal penalties, there are certain scenarios where penalties may be waived or reduced. Let’s explore some of the exceptions to these penalties.

Hardship Withdrawals

In cases of financial hardship, individuals may be eligible for penalty-free withdrawals from their 401(k) accounts. The criteria for hardship withdrawals typically include situations such as:

- Unreimbursed medical expenses

- Purchase of a primary residence

- Paying for higher education expenses

- Preventing eviction or foreclosure

Age-Based Exceptions

Individuals who are at least 59 1/2 years old are generally exempt from early withdrawal penalties. Once you reach this age, you can withdraw funds from your 401(k) without facing any penalties.

Penalty Exemptions for Disability

If you become permanently disabled and are unable to work, you may qualify for penalty-free withdrawals from your 401(k) account. This exemption is aimed at providing financial support to individuals who are no longer able to earn an income due to their disability.

Impact of 401(k) Withdrawal Penalties

Withdrawing funds from your 401(k) before reaching the eligible age can have significant financial consequences, primarily due to the penalties incurred.

Financial Consequences

- Early withdrawal penalties typically range from 10% to 25% of the amount withdrawn, depending on the specific circumstances.

- These penalties are in addition to the regular income taxes that must be paid on the withdrawn amount.

- Over time, the compounding effect of these penalties and taxes can significantly reduce the amount of retirement savings you have accumulated.

- Furthermore, withdrawing funds early disrupts the intended purpose of a 401(k) account, which is to provide income during retirement.

Impact on Retirement Savings and Financial Goals

- Penalties can erode a substantial portion of your retirement savings, leaving you with less money to support yourself in your later years.

- By withdrawing funds early, you miss out on the potential growth and compounding of your investments over time, hindering your ability to achieve long-term financial goals.

- Reduced retirement savings may also lead to a lower standard of living in retirement, as you may not have enough funds to cover essential expenses.

Strategies to Minimize Impact

- One strategy to minimize the impact of penalties is to explore other sources of funds before tapping into your 401(k), such as emergency savings or low-interest loans.

- If you must withdraw funds from your 401(k), consider taking only the amount you absolutely need to cover immediate expenses to reduce the overall impact on your retirement savings.

- Consult with a financial advisor to explore alternative options for addressing financial needs without incurring substantial penalties on your 401(k) withdrawals.