As 529 college savings plans take the spotlight, readers are invited into a realm rich with valuable insights and information. Dive into the intricacies of saving for higher education with this comprehensive guide.

Delve into the nuances of 529 plans, from understanding their structure to maximizing their potential for future educational needs.

What are 529 college savings plans?

529 college savings plans are tax-advantaged investment accounts specifically designed to help families save for future educational expenses. These plans are sponsored by states, state agencies, or educational institutions, and offer a flexible way to save for education costs.

How do 529 plans work?

529 plans work by allowing account holders to contribute money that grows tax-free as long as it is used for qualified education expenses. These expenses can include tuition, fees, books, supplies, and in some cases, room and board. The funds can be used at eligible institutions such as colleges, universities, and vocational schools.

- Contributions to 529 plans are made with after-tax dollars, meaning the money grows tax-free over time.

- Account holders can choose from various investment options, such as mutual funds, to help their savings grow.

- Withdrawals from 529 plans for qualified education expenses are not subject to federal income tax.

Benefits of investing in a 529 plan

Investing in a 529 plan offers various benefits for individuals and families looking to save for education expenses.

- Flexible contribution limits and account ownership options make 529 plans accessible for a wide range of savers.

- State-sponsored 529 plans may offer additional tax benefits, such as state income tax deductions or credits for contributions.

- 529 plans can be used at eligible institutions nationwide, providing flexibility for students attending different schools.

Tax advantages associated with 529 plans

529 plans offer several tax advantages that make them an attractive option for education savings.

- Contributions to a 529 plan grow tax-deferred, meaning earnings are not subject to federal income tax.

- Withdrawals for qualified education expenses are tax-free at the federal level, providing a significant tax advantage for account holders.

- Some states offer additional tax benefits, such as deductions or credits for contributions to a 529 plan.

Types of 529 College Savings Plans

When considering 529 college savings plans, it is important to understand the different types available to investors. Two main types are prepaid tuition plans and education savings plans, each with its own set of features and benefits.

Prepaid Tuition Plans vs. Education Savings Plans

Prepaid tuition plans allow account holders to prepay for tuition at eligible colleges and universities at today’s prices, offering protection against tuition inflation. On the other hand, education savings plans, also known as 529 savings plans, allow for contributions to be invested in a variety of investment options, with the potential for growth over time based on market performance.

State-Sponsored 529 Plans vs. Private 529 Plans

State-sponsored 529 plans are typically offered by individual states and may provide state tax benefits for residents who contribute to the plan. Private 529 plans, on the other hand, are offered by financial institutions and may have different investment options and fee structures compared to state-sponsored plans. It is important to compare the features and benefits of both types of plans before making a decision.

Investment Options Available within 529 Plans

529 plans offer a range of investment options, including mutual funds, target-date funds, and age-based portfolios. These options allow investors to choose a strategy that aligns with their risk tolerance and investment goals. It is essential to review the investment options within a 529 plan and select the ones that best suit your financial objectives.

Flexibility of Using Funds from a 529 Plan

Funds from a 529 plan can be used for qualified education expenses, including tuition, fees, books, supplies, and certain room and board costs at eligible institutions. Additionally, recent changes in legislation have expanded the usage of 529 plan funds to cover expenses for K-12 education and apprenticeship programs. This flexibility makes 529 plans a versatile tool for saving for education expenses at various levels.

Opening and managing a 529 plan

When it comes to opening and managing a 529 college savings plan, it is essential to understand the process, select the right plan for your specific needs, contribute regularly, and consider the implications of changing beneficiaries or using the funds for other purposes.

Selecting the Right 529 Plan

- Consider your investment goals and risk tolerance when choosing between a prepaid tuition plan or an education savings plan.

- Compare the fees, investment options, and performance of different 529 plans to find one that aligns with your financial objectives.

- Look for state-specific tax benefits or incentives that may be offered for investing in your state’s 529 plan.

Contributing to and Managing a 529 Plan

- Set up automatic contributions to ensure consistent savings towards your child’s education.

- Monitor the performance of your investments periodically and adjust your contributions based on your financial situation.

- Stay informed about any changes in the plan’s terms or fees to make informed decisions about managing your 529 account.

Implications of Changing Beneficiaries or Using Funds for Other Purposes

- Changing beneficiaries may have tax implications, so it is crucial to understand the rules and regulations governing beneficiary changes in a 529 plan.

- If you need to use the funds for non-qualified expenses, be aware of potential penalties and taxes that may apply to the earnings portion of the withdrawal.

- Consider alternative options for using leftover funds, such as transferring them to another family member’s 529 plan or saving them for future educational expenses.

Maximizing 529 college savings plans

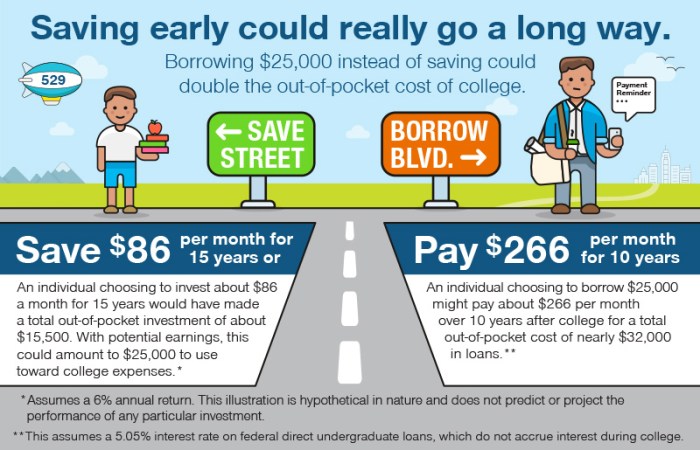

When it comes to maximizing 529 college savings plans, there are several strategies that families can implement to ensure the growth of funds and effective coverage of educational expenses. It is essential to understand the impact of financial aid on these plans and how contributions from grandparents or other family members can play a crucial role in achieving the desired savings goals.

Strategies for Maximizing Growth

- Regular Contributions: Consistent contributions over time can help maximize the growth of funds within a 529 plan. Setting up automatic contributions can ensure a disciplined approach to saving for education.

- Investment Selection: Choosing the right investment options based on the child’s age and risk tolerance can help optimize returns within the plan. It is essential to review and adjust investments periodically.

- Tax Benefits: Take advantage of tax benefits associated with 529 plans, such as tax-free growth and withdrawals for qualified educational expenses. Understanding the tax implications can help maximize savings.

Impact of Financial Aid

- Financial Aid Considerations: Funds held in a 529 plan can impact a student’s eligibility for financial aid. While these funds are considered parental assets, they are assessed at a lower rate compared to student assets.

- Strategic Withdrawals: Timing withdrawals from a 529 plan strategically can minimize the impact on financial aid eligibility. Coordinate withdrawals with other funding sources to cover educational expenses effectively.

Effective Use of 529 Plans

- Tuition and Fees: 529 plans can be used to cover tuition, fees, and other qualified educational expenses at eligible institutions. Making direct payments from the plan to the educational institution can streamline the process.

- Room and Board: Funds from a 529 plan can also be used to cover room and board expenses for students enrolled at least half-time. Understanding the limitations and guidelines for these expenses is crucial.

Role of Grandparents and Family Members

- Gift Contributions: Grandparents and other family members can make gift contributions to a 529 plan, which can benefit from tax advantages and help boost savings for education.

- Coordination with Parents: Collaborating with parents on contributions and withdrawals from the 529 plan can ensure a cohesive approach to funding educational expenses and maximizing savings.