Diving into the realm of Asset allocation strategies, this introduction sets the stage for a comprehensive exploration of the topic. From defining the strategies to understanding their importance in a diversified portfolio, readers will embark on a journey of knowledge and insight.

As we delve deeper into the nuances of asset allocation strategies, we will uncover the intricacies of different asset classes and their role in shaping investment decisions.

Overview of Asset Allocation Strategies

Asset allocation strategies refer to the practice of spreading investments across various asset classes to achieve a balance between risk and reward. This strategic approach aims to optimize returns while minimizing potential losses.

The importance of asset allocation in a diversified portfolio cannot be overstated. By diversifying investments across different asset classes, such as stocks, bonds, real estate, and commodities, investors can reduce the overall risk exposure of their portfolio. This helps to ensure that a downturn in one asset class does not have a catastrophic impact on the entire investment.

Examples of Different Asset Classes

- Stocks: Stocks represent ownership in a company and offer the potential for high returns but also come with higher volatility.

- Bonds: Bonds are debt securities issued by governments or corporations, providing a fixed income stream and lower risk compared to stocks.

- Real Estate: Real estate investments can include residential or commercial properties, offering potential appreciation and rental income.

- Commodities: Commodities such as gold, oil, and agricultural products provide a hedge against inflation and geopolitical risks.

Types of Asset Allocation Strategies

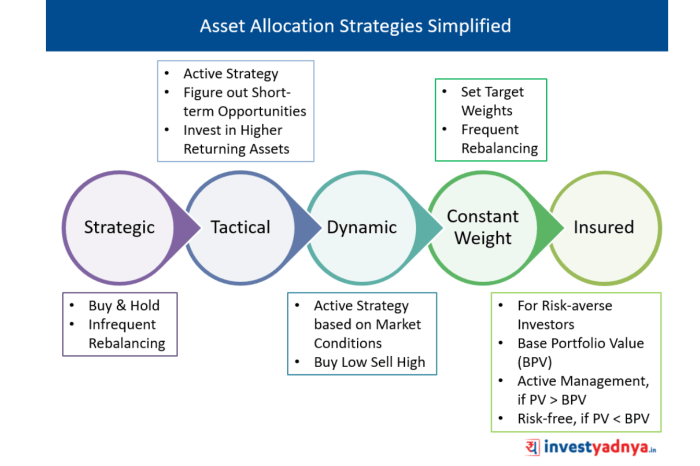

Asset allocation strategies can be broadly categorized into three main types: strategic, tactical, and dynamic. Each type of strategy adapts differently to market conditions, offering unique advantages and considerations for investors.

Strategic asset allocation involves setting a long-term target mix of assets based on an investor’s risk tolerance, financial goals, and time horizon. This allocation is typically rebalanced periodically to maintain the desired asset mix. Strategic asset allocation relies on the principle of diversification to spread risk across different asset classes.

Tactical asset allocation, on the other hand, involves making short-term adjustments to the asset mix based on market conditions or economic outlook. This strategy aims to capitalize on short-term opportunities or mitigate potential risks by deviating from the long-term strategic allocation. Tactical asset allocation requires active monitoring of market trends and the ability to react swiftly to changing conditions.

Dynamic asset allocation combines elements of both strategic and tactical approaches. It involves systematically adjusting the asset allocation based on predefined rules or triggers, such as market indicators or economic data. Dynamic asset allocation seeks to capture opportunities for growth while managing downside risk through a more flexible approach to portfolio management.

Real-World Examples

- Strategic Asset Allocation: A pension fund that follows a strategic asset allocation plan of 60% stocks and 40% bonds, rebalanced annually to maintain the target mix.

- Tactical Asset Allocation: A hedge fund manager who shifts allocations between different sectors based on short-term market trends and economic indicators to capitalize on emerging opportunities.

- Dynamic Asset Allocation: An automated investment platform that adjusts the asset mix of a portfolio based on preset rules triggered by market volatility or economic data, aiming to optimize returns while managing risk.

Factors Influencing Asset Allocation Decisions

When making asset allocation decisions, investors consider several key factors that play a crucial role in shaping their investment strategy. These factors include risk tolerance, investment goals, time horizon, economic conditions, and market trends.

Risk Tolerance

Risk tolerance refers to an investor’s ability to withstand fluctuations in the value of their investments. It is essential to consider risk tolerance when determining asset allocation as it helps investors choose the right mix of assets that align with their comfort level regarding market volatility. Investors with a higher risk tolerance may allocate a larger portion of their portfolio to equities, while those with a lower risk tolerance may lean towards more conservative investments like bonds.

Investment Goals

Investment goals vary among investors and can include objectives such as capital preservation, income generation, or capital appreciation. These goals influence asset allocation decisions as they determine the desired outcomes of the investment portfolio. For example, investors seeking long-term growth may opt for a more aggressive asset allocation strategy, while those focused on income may choose a more conservative approach.

Time Horizon

The time horizon refers to the length of time an investor plans to hold their investments before needing to access the funds. It plays a significant role in asset allocation decisions as it impacts the ability to withstand short-term market fluctuations. Investors with a longer time horizon may have the flexibility to take on more risk in their portfolio, while those with a shorter time horizon may opt for a more conservative approach to protect their capital.

Economic Conditions and Market Trends

Economic conditions and market trends can have a significant impact on asset allocation choices. Investors need to consider factors such as interest rates, inflation, and overall market conditions when making investment decisions. For example, during periods of economic uncertainty, investors may shift towards safer assets like gold or bonds, while in times of economic expansion, they may increase exposure to equities for higher growth potential.

Best Practices for Implementing Asset Allocation Strategies

Implementing asset allocation strategies effectively requires careful planning and attention to detail. By following best practices, investors can design a personalized strategy, utilize rebalancing techniques, and monitor and adjust their asset allocation based on changing circumstances.

Designing a Personalized Asset Allocation Strategy

Designing a personalized asset allocation strategy involves several key steps to ensure alignment with an individual’s financial goals, risk tolerance, and time horizon:

- Evaluate financial goals and risk tolerance: Begin by assessing your financial goals and risk tolerance to determine the appropriate mix of assets.

- Consider time horizon: Take into account your investment time horizon, as longer time horizons may allow for more aggressive allocations.

- Diversify across asset classes: Spread investments across different asset classes to reduce risk and enhance potential returns.

Rebalancing Techniques

Rebalancing is essential to maintain the desired asset allocation over time. Here are some techniques to consider:

- Set rebalancing parameters: Determine specific thresholds for asset allocation deviations that trigger rebalancing actions.

- Regularly review portfolio: Conduct periodic reviews of your portfolio to identify any deviations from the target allocation.

- Buy low, sell high: Rebalance by selling assets that have performed well and buying assets that are underperforming to bring the portfolio back in line with the target allocation.

Monitoring and Adjusting Asset Allocation

Monitoring and adjusting asset allocation is crucial to respond to changing market conditions and financial goals. Here are some tips for effective monitoring and adjustment:

- Regularly review performance: Monitor the performance of your portfolio regularly to ensure it aligns with your investment objectives.

- Stay informed: Stay up-to-date on market trends, economic indicators, and other factors that may impact your asset allocation decisions.

- Adjust based on changing circumstances: Make adjustments to your asset allocation as needed based on changes in your financial situation, risk tolerance, or market conditions.