As Building credit history takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Credit history plays a crucial role in financial transactions, influencing everything from loan approvals to interest rates. Understanding how to build and maintain a solid credit history is essential for financial stability and growth.

What is Credit History?

Credit history refers to a record of an individual’s borrowing and repayment behavior. It plays a crucial role in determining a person’s creditworthiness and financial reputation. Lenders, such as banks and credit card companies, use this information to assess the risk of lending money to an individual.

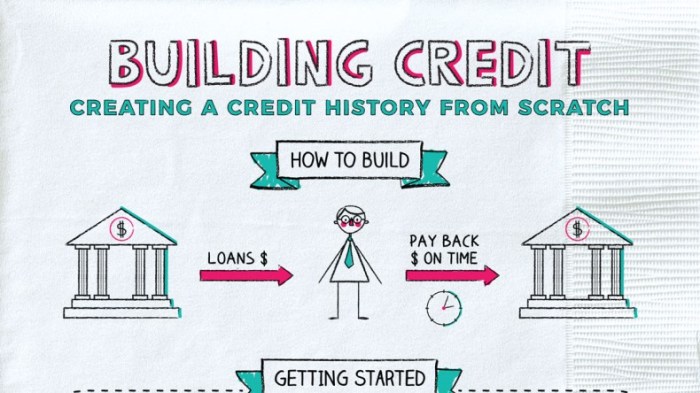

Building Credit History

Building credit history is a gradual process that involves various financial activities. Here are the key factors that influence a person’s credit history:

- Payment History: Timely payments on loans, credit cards, and other bills contribute positively to one’s credit history. Late payments or defaults can have a negative impact.

- Credit Utilization: Keeping credit card balances low relative to the credit limit demonstrates responsible credit management and can improve credit scores.

- Length of Credit History: The longer a person has had credit accounts open, the more data is available to assess creditworthiness. Establishing a long credit history can be beneficial.

- Types of Credit Used: Having a mix of credit accounts, such as credit cards, installment loans, and mortgages, can show that an individual can manage various types of credit responsibly.

- New Credit: Opening multiple new credit accounts in a short period can raise red flags for lenders, as it may indicate financial distress or excessive borrowing.

Importance of Building Credit History

Building a good credit history is essential for maintaining financial stability and achieving long-term financial goals. A positive credit history reflects a person’s ability to manage debt responsibly, which can open up various opportunities for obtaining credit and financial products.

Benefits of a Positive Credit History

- Access to Loans: Lenders are more likely to approve loan applications from individuals with a strong credit history, as it demonstrates reliability in repaying debts.

- Lower Interest Rates: A good credit score can lead to lower interest rates on loans, mortgages, and credit cards, saving the individual money over time.

- Higher Credit Limits: With a positive credit history, individuals may qualify for higher credit limits, providing more financial flexibility.

- Approval for Renting: Landlords often check credit history when considering rental applications, and a good credit score can increase the chances of approval.

- Employment Opportunities: Some employers review credit reports as part of the hiring process, and a positive credit history can enhance job prospects.

A strong credit history is a valuable asset that can pave the way for financial success and stability.

Ways to Build Credit History

Establishing and improving credit history is essential for financial stability and future opportunities. There are several strategies individuals can use to build a positive credit history:

Using Credit Cards Responsibly

- Make small purchases on a credit card and pay off the balance in full each month to show responsible credit usage.

- Avoid maxing out credit cards and keep utilization below 30% to demonstrate responsible credit management.

Making Timely Payments

- Always pay bills, loans, and credit card payments on time to avoid late fees and negative marks on your credit report.

- Set up automatic payments or reminders to ensure payments are made promptly each month.

Monitoring Credit Reports

- Regularly review your credit report for errors or fraudulent activity that could negatively impact your credit score.

- Dispute any inaccuracies on your credit report to maintain an accurate credit history.

Keeping Credit Utilization Low

- Avoid opening multiple new credit accounts at once, as this can lower the average age of your credit history.

- Only apply for credit when necessary and keep credit utilization low to show responsible credit management.

Starting to Build Credit

- Consider becoming an authorized user on someone else’s credit card to start building credit history.

- Apply for a secured credit card or credit-builder loan to establish a positive credit history if you have no credit or a limited credit history.

Common Mistakes to Avoid

Missing payments, maxing out credit cards, and closing old accounts are common pitfalls that can have a negative impact on your credit history. These mistakes can hinder credit score growth and limit future financial opportunities. It is important to be aware of these pitfalls and know how to avoid them to maintain a healthy credit history.

Missing Payments

Missing payments on your credit accounts can significantly damage your credit score. Late payments not only incur costly fees and interest charges but also stay on your credit report for years. This negative mark can lower your credit score and make it harder to qualify for loans or credit cards in the future.

Maxing Out Credit Cards

Maxing out your credit cards or carrying high balances can also harm your credit history. This high credit utilization ratio signals to lenders that you may be overextended financially and pose a higher risk. It is recommended to keep your credit utilization below 30% to maintain a healthy credit score.

Closing Old Accounts

Closing old credit accounts, especially those with a long history of on-time payments, can shorten your credit history and reduce your overall available credit. This can negatively impact your credit score by increasing your credit utilization ratio and lowering the average age of your accounts. Instead of closing old accounts, consider keeping them open to maintain a longer credit history.