Delving into the realm of Health Savings Accounts (HSAs), one uncovers a financial tool that offers individuals a unique way to save for medical expenses while reaping tax benefits. As we navigate through the intricacies of HSAs, a clearer picture emerges of how this account can serve as a valuable asset in managing healthcare costs.

Exploring the nuances of eligibility, contribution limits, investment options, and the flexibility of using HSA funds, we unravel the layers of this financial instrument to empower individuals in making informed decisions about their healthcare finances.

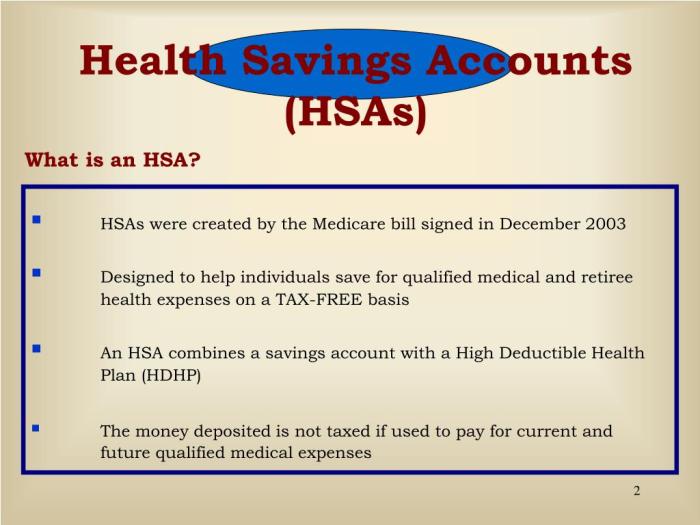

What are Health Savings Accounts (HSAs)?

Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for qualified medical expenses. These accounts are specifically created to work in conjunction with high-deductible health insurance plans.

Purpose of HSAs

Health Savings Accounts are intended to provide a way for individuals to set aside funds for medical expenses that may not be covered by their insurance plans. This includes expenses such as deductibles, copayments, and other out-of-pocket costs.

- HSAs offer a triple tax advantage, as contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

- These accounts can help individuals have more control over their healthcare spending and save for future medical needs.

- HSAs can also serve as a retirement savings vehicle, as funds can be used for non-medical expenses after the age of 65 without penalty (though taxes may apply).

How HSAs Work

To open an HSA, individuals must be covered by a high-deductible health insurance plan and not be enrolled in Medicare. Contributions to an HSA can be made by the account holder, their employer, or both, up to certain annual limits set by the IRS.

It’s important to note that unused funds in an HSA can be rolled over from year to year, unlike Flexible Spending Accounts (FSAs), which have a “use it or lose it” rule.

- HSAs typically come with a debit card or checks for easy access to funds when paying for qualified medical expenses.

- Account holders can invest their HSA funds in various investment options to potentially grow their savings over time.

Eligibility to Open an HSA

Individuals must meet certain criteria to be eligible to open an HSA, including:

- Being covered by a high-deductible health insurance plan

- Not being enrolled in Medicare

- Not being claimed as a dependent on someone else’s tax return

Benefits of Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer a range of advantages for individuals looking to save for medical expenses while enjoying tax benefits. By understanding the benefits of an HSA, individuals can make informed decisions about their healthcare savings strategy.

Tax Savings

- Contributions to an HSA are tax-deductible, meaning that the money you deposit into your HSA is not subject to federal income tax.

- Any interest or investment earnings on the funds in your HSA grow tax-free, allowing your savings to accumulate over time without being taxed.

- Withdrawals from an HSA for qualified medical expenses are also tax-free, providing a triple tax advantage for account holders.

Flexible Use of Funds

- Funds in an HSA can be used to pay for a wide range of medical expenses, including deductibles, copayments, prescriptions, and certain medical procedures that may not be covered by insurance.

- HSAs can also be used to cover expenses for vision and dental care, as well as certain over-the-counter medications and medical supplies.

- Unlike Flexible Spending Accounts (FSAs), funds in an HSA roll over from year to year, allowing individuals to build a substantial savings cushion for future healthcare needs.

Contribution Limits and Rules

Health Savings Accounts (HSAs) have annual contribution limits set by the IRS. These limits can change each year, so it’s important to stay updated on the current guidelines.

The rules regarding contributions to an HSA are straightforward. Contributions can be made by an eligible individual, their employer, or both. The total contributions cannot exceed the annual limit set by the IRS.

Annual Contribution Limits

- For 2021, the annual contribution limit for an individual with self-only coverage is $3,600, and for those with family coverage, it is $7,200.

- Individuals over 55 can make an additional catch-up contribution of $1,000 per year.

- These limits are subject to change, so it’s important to verify the current limits each year.

Catch-Up Contributions for Individuals Over 55

- Individuals who are 55 or older by the end of the tax year are eligible to make catch-up contributions to their HSA.

- The catch-up contribution limit for individuals over 55 is $1,000 per year in addition to the regular contribution limit.

- These catch-up contributions allow older individuals to save more for healthcare expenses as they near retirement.

Investment Options for HSAs

Health Savings Accounts (HSAs) offer individuals the opportunity to invest their funds for potential growth over time. Understanding the investment choices available and the strategies involved can help account holders make informed decisions for maximizing their HSA funds.

Types of Investment Choices

- Individual Stocks: Investing in individual stocks allows account holders to have direct ownership in specific companies. This option provides the potential for high returns but also comes with higher risks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This option offers diversification and professional management.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on an exchange like a stock. They offer diversification and low expense ratios.

Potential for Growth through Investing HSA Funds

By investing HSA funds wisely, individuals have the opportunity to earn returns on their contributions over time. The compounding effect of growth can significantly increase the account balance, providing additional funds for future healthcare expenses.

Comparison of Investment Strategies

| Investment Strategy | Key Features |

|---|---|

| Aggressive | Focuses on high-risk, high-reward investments for potentially higher returns. |

| Moderate | Balances risk and reward with a diversified portfolio to achieve stable growth. |

| Conservative | Emphasizes low-risk investments to preserve capital and generate steady, but lower returns. |

Using HSA Funds

Health Savings Accounts (HSAs) allow individuals to save and invest funds for qualified medical expenses. Here, we will explore how you can use HSA funds for various purposes.

Qualified Medical Expenses

HSAs can be used to cover a wide range of medical expenses, including:

- Doctor’s visits

- Prescription medications

- Hospital stays

- Medical procedures

- Mental health services

- Dental and vision care

Reimbursing Yourself for Medical Expenses

If you pay for medical expenses out of pocket, you can reimburse yourself from your HSA. Keep receipts and documentation of the expenses, and submit a request for reimbursement from your HSA provider. It is important to maintain accurate records for tax purposes.

Using HSA Funds for Non-Medical Expenses After Retirement

After the age of 65, you can withdraw funds from your HSA for non-medical expenses without penalty. While these withdrawals are subject to income tax, the flexibility of using HSA funds for any purpose in retirement can provide additional financial security.

Employer Contributions and HSAs

Employer contributions to Health Savings Accounts (HSAs) play a significant role in enhancing an individual’s healthcare savings and overall financial wellness. These contributions are a valuable benefit that many employers offer to their employees to help cover medical expenses and promote a culture of health and well-being in the workplace.

How Employer Contributions to an Employee’s HSA Work

Employer contributions to an employee’s HSA are typically made either as a lump sum amount at the beginning of the year or through regular payroll deductions. The employer may choose to contribute a specific dollar amount or a percentage of the employee’s annual deductible. These contributions are tax-deductible for the employer and tax-free for the employee, making them a tax-efficient way to save for healthcare expenses.

Tax Implications of Employer Contributions to an HSA

Employer contributions to an employee’s HSA are excluded from the employee’s taxable income, reducing their overall tax liability. Additionally, these contributions are not subject to FICA taxes, further maximizing the tax benefits for both the employer and the employee. It’s important to note that there are annual limits on employer contributions to an employee’s HSA, which are set by the IRS.

How Employer Contributions Can Affect an Individual’s Overall Healthcare Costs

Employer contributions to an employee’s HSA can have a significant impact on their overall healthcare costs. By increasing the funds available in the HSA, employees can cover a wider range of medical expenses without having to dip into their personal savings. This can lead to lower out-of-pocket costs for the employee and provide a financial safety net for unexpected healthcare needs. Additionally, employer contributions can help employees save for future medical expenses and build a substantial healthcare fund over time.