Kicking off with the Impact of credit scores on loans, this opening paragraph is designed to captivate and engage the readers, setting the tone formal with a serious style that unfolds with each word. It delves into the intricacies of credit scores and their profound impact on loan approval and terms.

Exploring the factors affecting credit scores and the strategies to improve them for better loan terms will provide a comprehensive understanding of the subject matter.

Impact of credit scores on loan approval

Credit scores play a crucial role in determining whether an individual qualifies for a loan. Lenders rely on credit scores to assess the creditworthiness of borrowers and make informed decisions about loan approvals.

How credit scores influence loan approval decisions

Having a high credit score indicates to lenders that an individual has a history of managing credit responsibly, making them less risky borrowers. On the other hand, a low credit score may signal to lenders that the borrower has had difficulty managing credit in the past, potentially leading to a higher likelihood of default. As a result, individuals with higher credit scores are more likely to be approved for loans compared to those with lower credit scores.

Examples of how credit scores can affect interest rates on loans

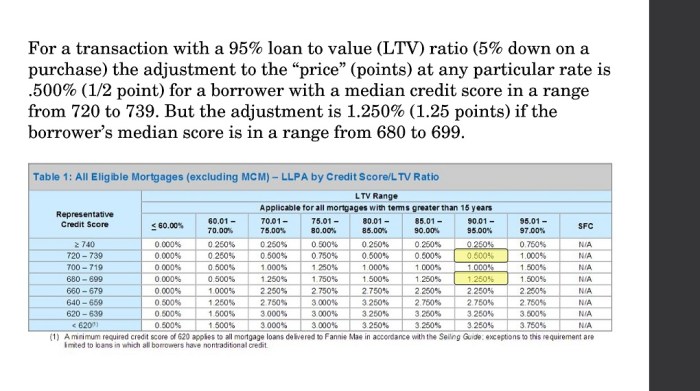

Lenders often use credit scores to determine the interest rates offered to borrowers. Individuals with higher credit scores typically qualify for lower interest rates, as they are considered less risky borrowers. Conversely, individuals with lower credit scores may face higher interest rates to compensate for the increased risk they pose to lenders. For example, a borrower with an excellent credit score may receive a mortgage loan with a 3% interest rate, while a borrower with a poor credit score may be offered the same loan with a 7% interest rate.

Relationship between credit scores and loan eligibility criteria

Loan eligibility criteria often include minimum credit score requirements. Lenders use credit scores as a benchmark to determine whether an individual meets the necessary creditworthiness standards for a particular loan. Individuals with higher credit scores are more likely to meet these criteria and qualify for loans, while those with lower credit scores may struggle to meet the eligibility requirements. This highlights the importance of maintaining a good credit score to improve one’s chances of loan approval.

Factors affecting credit scores

Understanding the various factors that influence credit scores is crucial for maintaining financial health and securing favorable loan terms.

Payment History

The payment history is a key component of credit scores, accounting for about 35% of the total score. Timely payments on credit accounts, such as credit cards, loans, and mortgages, demonstrate reliability and responsibility, positively impacting the credit score. On the other hand, missed or late payments can significantly lower the credit score and indicate financial instability.

Credit Utilization

Credit utilization is another important factor that affects credit scores, representing about 30% of the total score. This factor measures the amount of credit being used compared to the total available credit limit. Keeping credit utilization low, ideally below 30%, shows responsible credit management and can boost the credit score. High credit utilization indicates potential financial strain and can negatively impact the credit score.

Improving credit scores for better loan terms

Improving your credit score is essential to secure more favorable loan terms and interest rates. Lenders use credit scores to evaluate your creditworthiness and determine the risk of lending you money. By implementing strategies to boost your credit score, you can increase your chances of approval and access better loan options.

Strategies for improving credit scores

- Pay your bills on time: Late payments can significantly impact your credit score. Make sure to pay all your bills by their due dates to demonstrate responsible financial behavior.

- Reduce credit card balances: High credit card balances relative to your credit limit can negatively affect your credit score. Aim to keep your credit utilization ratio below 30%.

- Regularly check your credit report: Monitor your credit report for errors or inaccuracies that could be dragging down your score. Dispute any discrepancies to ensure your credit report is up to date.

- Limit new credit applications: Multiple credit inquiries within a short period can lower your credit score. Be strategic about applying for new credit and only do so when necessary.

Tips to maintain a healthy credit score

- Keep old accounts open: Closing old accounts can shorten your credit history and potentially lower your score. Keep old accounts open to maintain a longer credit history.

- Avoid maxing out credit cards: Using up your entire credit limit can signal financial distress to lenders. Aim to keep your credit card balances low to improve your credit score.

- Diversify your credit mix: Having a mix of credit types, such as credit cards, loans, and a mortgage, can positively impact your credit score. Show that you can manage different types of credit responsibly.

Long-term benefits of having a good credit score

Having a good credit score goes beyond securing favorable loan terms. It can also lead to lower interest rates on credit cards, better insurance premiums, and even approval for rental applications. Additionally, a strong credit score can provide peace of mind knowing that you have financial stability and options available to you in the future.

Impact of credit scores on loan types

When it comes to different types of loans, credit scores play a crucial role in determining not only the approval process but also the terms and conditions offered to borrowers.

Credit Scores Influence on Mortgage, Personal, and Auto Loans

Here is how credit scores can impact different types of loans:

- Mortgage Loans: A higher credit score typically leads to lower interest rates and better terms on mortgage loans. Borrowers with lower credit scores may face challenges in securing a mortgage or may end up paying higher interest rates.

- Personal Loans: Credit scores also influence the interest rates and approval decisions for personal loans. Higher credit scores are often associated with lower interest rates and higher loan amounts.

- Auto Loans: Similar to other types of loans, credit scores can affect the interest rates and loan terms for auto loans. Borrowers with higher credit scores may qualify for better loan terms and lower interest rates.

Impact on Secured vs. Unsecured Loans

When it comes to secured and unsecured loans, credit scores can have different implications:

- Secured Loans: For secured loans, such as mortgages or auto loans, credit scores may impact the interest rates and down payment requirements. Higher credit scores can lead to better terms and lower down payment amounts.

- Unsecured Loans: In the case of unsecured loans, like personal loans, credit scores play a significant role in the approval process. Lenders may be more cautious with borrowers who have lower credit scores, potentially leading to higher interest rates or lower loan amounts.

Role in Determining Loan Amounts

Credit scores also influence the loan amounts that borrowers can qualify for across different loan types:

- Higher credit scores are often associated with larger loan amounts, as lenders view borrowers with good credit as less risky and more likely to repay the loan.

- Borrowers with lower credit scores may face limitations on the loan amounts they can access, as lenders may perceive them as higher risk and may offer smaller loan amounts or less favorable terms.