Investment diversification is a fundamental aspect of portfolio management, playing a pivotal role in shaping the success of investments. By spreading investments across various asset classes, investors can mitigate risks and potentially enhance long-term returns. Let’s delve into the intricacies of investment diversification and explore its significance in the realm of finance.

Importance of Investment Diversification

Investment diversification is a crucial strategy in portfolio management that involves spreading your investments across different asset classes to reduce risk and improve overall returns. By diversifying your portfolio, you can protect yourself from the volatility of any single investment or asset class.

Reducing Risk in Investment Portfolio

Diversification helps reduce risk by ensuring that a single negative event or economic downturn does not have a catastrophic impact on your entire portfolio. For example, if you have all your investments in one industry and that industry experiences a downturn, your entire portfolio would suffer. However, if you have investments in multiple industries or asset classes, the losses from one area can be offset by gains in another, reducing overall risk exposure.

Enhancing Long-Term Returns

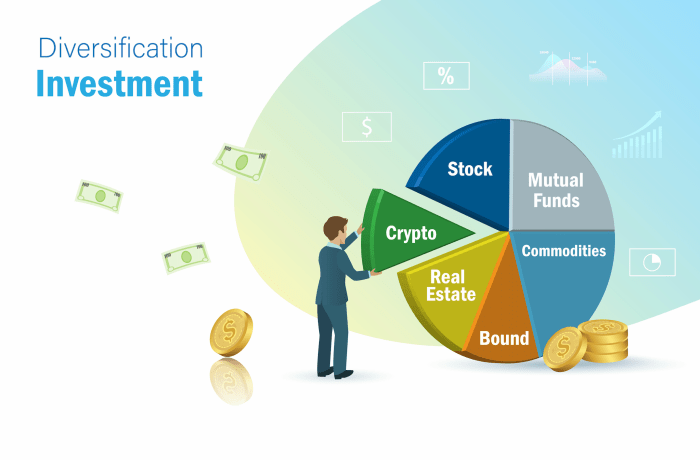

Diversification can also enhance long-term returns for investors by maximizing returns while minimizing risk. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can take advantage of different market cycles and opportunities. This can help smooth out the ups and downs in your portfolio and potentially provide more consistent returns over time.

Types of Investment Diversification

Investment diversification can take many forms, with different asset classes offering unique benefits and risks. By spreading investments across various assets, investors can reduce the overall risk of their portfolio and potentially enhance returns. Let’s explore the different types of asset classes that can be included in a diversified investment portfolio and strategies for achieving diversification within each asset class.

Stocks

When diversifying through stocks, investors can consider spreading their investments across different industries, sectors, and geographic regions. This helps mitigate the risk of any single stock or sector underperforming. Additionally, investors can diversify by market capitalization, including large-cap, mid-cap, and small-cap stocks in their portfolio.

Bonds

Diversifying through bonds involves investing in different types of bonds, such as government bonds, corporate bonds, municipal bonds, and high-yield bonds. Investors can also diversify by bond duration, with short-term, intermediate-term, and long-term bonds offering varying levels of risk and return potential.

Real Estate

Real estate can be a valuable addition to a diversified investment portfolio. Investors can diversify through direct ownership of properties, real estate investment trusts (REITs), or real estate crowdfunding platforms. By investing in different types of properties, such as residential, commercial, or industrial real estate, investors can spread risk across the real estate sector.

Other Assets

In addition to stocks, bonds, and real estate, investors can diversify their portfolios by including other assets such as commodities, precious metals, and alternative investments like hedge funds or private equity. These alternative assets can provide further diversification benefits and potentially enhance portfolio returns.

Overall, diversification through different asset classes is essential for building a well-rounded investment portfolio that can withstand market fluctuations and deliver long-term growth. By carefully selecting a mix of assets and employing various diversification strategies within each asset class, investors can optimize their risk-return profile and achieve their financial goals.

Risk Management Strategies through Diversification

Diversification is a key strategy for managing various types of investment risks. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of market volatility on your overall portfolio.

The Role of Correlation in Diversifying a Portfolio

Correlation refers to the statistical relationship between the returns of two or more investments. When assets have a low correlation or are negatively correlated, they tend to move in opposite directions. This means that when one investment is performing poorly, the other may be performing well, helping to offset losses and stabilize the overall portfolio.

- For example, during a market downturn, stocks and bonds typically have a negative correlation. While stock prices may be falling, bond prices may be rising as investors seek safer assets. By holding a mix of stocks and bonds in your portfolio, you can reduce the impact of market fluctuations on your overall wealth.

- Real estate investment trusts (REITs) are another example of an asset class that can be negatively correlated with stocks. During times of economic uncertainty, REITs may provide steady income and capital appreciation, helping to diversify your investment portfolio and reduce risk.

Implementing Diversification in Investment Portfolios

Designing a diversified investment portfolio is crucial for managing risk and maximizing returns. It involves a strategic allocation of assets across different investment categories to spread out risk and enhance overall portfolio performance.

Steps in Designing a Diversified Investment Portfolio

- Assess Your Risk Tolerance: Understand your risk appetite and investment goals before determining the level of diversification needed.

- Identify Investment Options: Research and select a mix of assets such as stocks, bonds, real estate, and commodities to include in your portfolio.

- Allocate Assets: Determine the percentage of each asset class in your portfolio based on your risk tolerance, time horizon, and financial objectives.

- Monitor Performance: Regularly review the performance of each asset class and make adjustments as needed to maintain diversification.

Tips for Effective Asset Allocation

- Consider Correlations: Choose assets that have low correlations to each other to further reduce risk.

- Diversify Within Asset Classes: Spread investments within each asset class to minimize exposure to specific risks.

- Rebalance Periodically: Adjust the allocation of assets over time to ensure that your portfolio remains diversified according to your investment strategy.

Guidelines for Monitoring and Adjusting a Diversified Portfolio

- Set Clear Objectives: Define your investment goals and regularly assess whether your portfolio is aligned with these objectives.

- Stay Informed: Keep yourself updated on market trends, economic conditions, and changes in the investment landscape that may impact your portfolio.

- Seek Professional Advice: Consider consulting with a financial advisor to get expert guidance on managing and optimizing your diversified portfolio.