Exploring the differences between Mutual funds and ETFs opens up a world of investment opportunities for individuals seeking to maximize their returns. As we delve into the intricacies of these two popular investment options, a clearer understanding of their structures, costs, and tax implications will emerge.

Introduction

Mutual funds and Exchange-Traded Funds (ETFs) are popular investment options for individuals looking to diversify their portfolios and potentially earn returns on their investments. Mutual funds are professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. On the other hand, ETFs are similar to mutual funds in that they also pool money from multiple investors, but they are traded on stock exchanges like individual stocks.

Key Differences Between Mutual Funds and ETFs

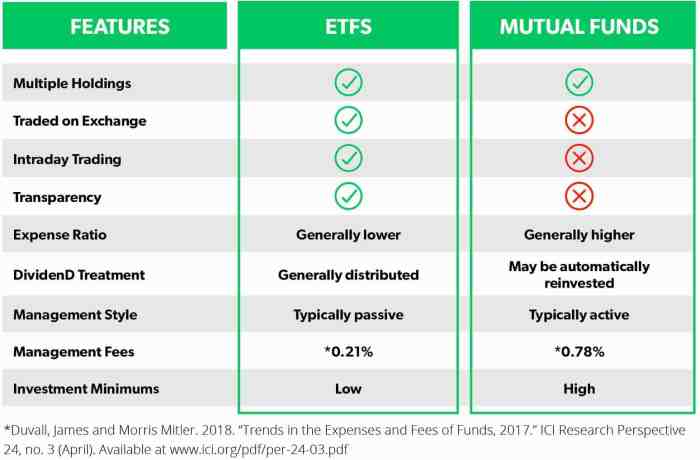

While both mutual funds and ETFs offer investors the opportunity to diversify their investments, there are key differences between the two investment options:

- Mutual funds are priced at the end of the trading day, while ETFs are traded throughout the day on stock exchanges.

- Mutual funds are bought and sold directly from the fund company, while ETFs are bought and sold through a brokerage account.

- Mutual funds may have minimum investment requirements, while ETFs can be purchased in single shares.

- Mutual funds may have load fees or sales charges, while ETFs typically have lower expense ratios.

Examples of Popular Mutual Funds and ETFs

| Mutual Funds | ETFs |

|---|---|

| Vanguard Total Stock Market Index Fund (VTSAX) | SPDR S&P 500 ETF (SPY) |

| Fidelity Contrafund (FCNTX) | iShares Core S&P 500 ETF (IVV) |

| American Funds Growth Fund of America (AGTHX) | Vanguard Total Stock Market ETF (VTI) |

Structure and Management

Mutual funds and ETFs differ in their structure and management styles, impacting how they operate and how investors may approach them.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. These funds are actively managed by professional fund managers who make investment decisions based on the fund’s objectives and strategy. The fund manager’s goal is to outperform a specific benchmark index or achieve a certain level of return for investors. Mutual funds are priced once a day at the end of the trading day based on the net asset value (NAV) of the fund.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they also pool money from multiple investors to invest in a basket of securities. However, ETFs are passively managed and typically track a specific index, such as the S&P 500. This means that the investment strategy of an ETF is predetermined based on the index it aims to replicate. ETFs are traded on stock exchanges throughout the day, with prices fluctuating based on supply and demand in the market.

Comparison of Management Styles

– Mutual funds are actively managed, meaning that fund managers actively buy and sell securities within the fund to meet the fund’s objectives and potentially outperform the market.

– ETFs, on the other hand, are passively managed and aim to replicate the performance of a specific index. This results in lower management fees compared to actively managed mutual funds.

– The active management of mutual funds may lead to higher fees due to the expertise and research involved in making investment decisions, while ETFs typically have lower expense ratios.

– Investors seeking potentially higher returns through active management may opt for mutual funds, while those looking for lower costs and index-like returns may prefer ETFs.

Liquidity and Trading

When it comes to investing in mutual funds and ETFs, liquidity and trading are crucial factors to consider. Liquidity refers to how easily an investor can buy or sell shares of a particular investment without significantly impacting its price. Let’s delve into how mutual funds and ETFs differ in terms of liquidity and trading mechanisms.

Liquidity of Mutual Funds

Mutual funds are typically less liquid compared to ETFs. This is because mutual funds are only traded at the end of the trading day at their net asset value (NAV). Investors looking to buy or sell mutual fund shares must do so through the fund company or an intermediary, such as a broker. The price at which shares are bought or sold is determined by the NAV calculated at the end of the trading day. This daily trading mechanism can result in delays and potentially higher costs for investors.

ETFs Offering Liquidity

ETFs, on the other hand, offer greater liquidity to investors. ETFs trade on stock exchanges throughout the trading day at market prices. This means investors can buy or sell ETF shares at any time during market hours at prevailing market prices. The ability to trade ETFs intraday provides investors with more flexibility and control over their investments compared to mutual funds. Additionally, the liquidity of ETFs is further enhanced by the presence of market makers who help ensure that ETF prices closely track their underlying assets.

Comparison of Trading Mechanisms

In terms of trading mechanisms, mutual funds and ETFs differ significantly. Mutual funds are only transacted at the end of the trading day at the NAV, which can lead to potential delays and uncertainty in pricing. In contrast, ETFs trade like individual stocks on exchanges, allowing investors to buy or sell shares at market prices throughout the trading day. The continuous trading of ETFs provides investors with the ability to react quickly to market changes and take advantage of intraday trading opportunities.

Costs and Fees

Investing in mutual funds and ETFs comes with costs and fees that investors should be aware of. These expenses can impact the overall returns of an investment over time.

Costs Associated with Investing in Mutual Funds

- Mutual funds typically charge investors expense ratios, which are annual fees calculated as a percentage of the fund’s assets. These fees cover the fund’s operating expenses, such as management fees, administrative costs, and marketing expenses.

- Investors may also incur sales charges, also known as loads, when buying or selling mutual fund shares. Front-end loads are charged at the time of purchase, while back-end loads are charged when shares are redeemed.

Fees Investors Incur When Investing in ETFs

- ETFs generally have lower expense ratios compared to mutual funds. The average expense ratio for ETFs is typically around 0.44%, which is lower than the average mutual fund expense ratio of around 0.74%.

- When buying and selling ETF shares, investors may need to pay brokerage commissions to their brokers. These commissions can vary depending on the broker and the trading platform used.

Comparison of Cost Structures

- Overall, ETFs tend to have lower costs and fees than mutual funds. This is mainly due to the passive management style of many ETFs, which results in lower management fees compared to actively managed mutual funds.

- Investors looking to minimize costs may find ETFs to be a more cost-effective investment option, especially for long-term investing where minimizing expenses can have a significant impact on overall returns.

Tax Efficiency

Investing in mutual funds can have tax implications for investors, as these funds are required to distribute capital gains and dividends to shareholders. This can lead to potential tax liabilities for investors, even if they did not sell any of their shares. On the other hand, ETFs are considered tax-efficient investments due to their unique structure and the way they are traded on an exchange.

Tax Implications of Investing in Mutual Funds

Mutual funds are required to distribute capital gains and dividends to shareholders, which can result in taxable events for investors. Even if an investor does not sell any of their shares, they may still be subject to taxes on these distributions. This can lead to potential tax liabilities for investors, depending on the fund’s performance and distribution policies.

Tax Efficiency of ETFs

ETFs are considered tax-efficient investments because of their unique structure. Unlike mutual funds, ETFs do not have to sell securities to meet investor redemptions, which can trigger capital gains taxes. Instead, investors buying or selling ETF shares on the secondary market do so with other market participants, minimizing the need for the fund manager to sell underlying assets. This can lead to lower capital gains distributions and potentially lower tax liabilities for investors.

Comparing Tax Efficiency of Mutual Funds and ETFs

When comparing the tax efficiency of mutual funds and ETFs, ETFs generally have an edge due to their structure and trading mechanism. The ability of ETFs to minimize capital gains distributions can result in lower tax liabilities for investors compared to traditional mutual funds. Investors looking to minimize the impact of taxes on their investment returns may find ETFs to be a more tax-efficient option compared to mutual funds.