Real estate investment strategies set the foundation for success in the dynamic world of real estate investing. By exploring various tactics and approaches, investors can navigate the market with confidence and achieve their financial goals with precision and insight.

As we delve deeper into the nuances of real estate investment strategies, we uncover a wealth of information that can guide investors towards making informed decisions and maximizing their returns.

Real Estate Investment Strategies

Real estate investment strategies refer to the approach or plan that investors use to make decisions about acquiring, managing, and selling properties with the goal of maximizing returns. These strategies can vary based on factors such as risk tolerance, financial goals, market conditions, and investment timelines.

Types of Real Estate Investment Strategies

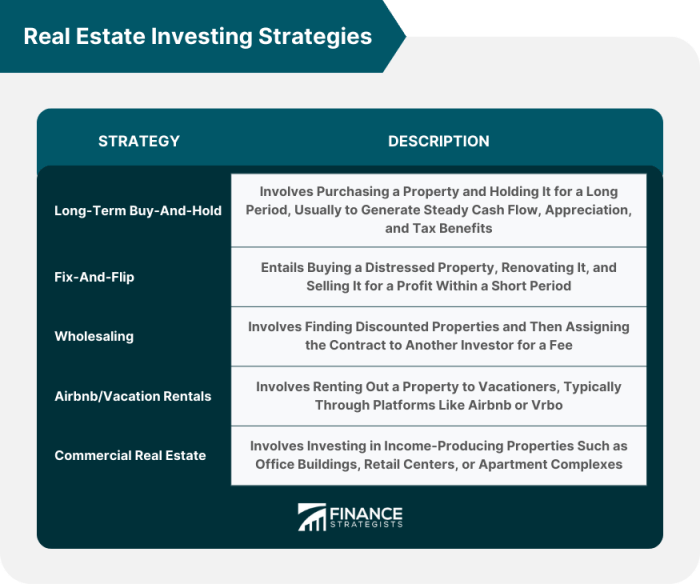

There are several types of real estate investment strategies that investors can consider:

- Buy and Hold: Investors purchase properties with the intention of holding onto them for an extended period, generating rental income, and benefiting from long-term appreciation.

- Fix and Flip: Investors buy properties that need renovation, make improvements to increase their value, and then sell them quickly for a profit.

- Wholesaling: Investors act as intermediaries, finding properties at below-market prices and selling them to other investors for a fee.

- REITs: Real Estate Investment Trusts allow investors to invest in real estate through publicly traded companies that own, operate, or finance income-producing properties.

Importance of a Well-Defined Investment Strategy

Having a well-defined investment strategy in real estate is crucial for success. It helps investors make informed decisions, stay focused on their goals, and mitigate risks. A clear strategy also enables investors to align their investments with their financial objectives and time horizon.

Variation of Real Estate Investment Strategies Based on Market Conditions

Real estate investment strategies may need to be adjusted based on market conditions. For example, in a seller’s market where demand exceeds supply, investors may focus on quick flips to capitalize on rising prices. In a buyer’s market with abundant inventory, buy and hold strategies could be more favorable to benefit from long-term appreciation.

Traditional vs. Modern Strategies

In the realm of real estate investment, there are distinct differences between traditional strategies that have been used for years and modern approaches that have emerged with advancements in technology and market dynamics.

Key Differences in Risk Management

Risk management is a crucial aspect of real estate investment, and the approaches taken in traditional and modern strategies differ significantly. In traditional strategies, risk management often relies heavily on personal experience, market knowledge, and conservative financial practices. Investors tend to focus on long-term property appreciation and steady rental income, with a cautious approach to leverage and debt. On the other hand, modern strategies leverage data analytics, AI algorithms, and predictive modeling to assess and mitigate risks more effectively. These approaches allow investors to make data-driven decisions, identify emerging trends, and adapt quickly to market changes, thus reducing overall risk exposure.

Impact of Technology

Technology has revolutionized modern real estate investment strategies, offering investors unprecedented access to data, market insights, and investment opportunities. Platforms utilizing big data and machine learning algorithms can analyze vast amounts of information to identify profitable properties, forecast market trends, and optimize portfolio performance. Online crowdfunding platforms have also democratized real estate investing, allowing small investors to pool resources and access projects that were once exclusive to institutional players. Additionally, technology has streamlined processes such as property management, tenant screening, and financial reporting, enhancing efficiency and transparency in real estate transactions.

Long-Term vs. Short-Term Strategies

When it comes to real estate investment strategies, investors often have to decide between long-term and short-term approaches. Each strategy has its own set of characteristics, advantages, and disadvantages.

Short-term strategies, on the other hand, involve buying and selling properties within a shorter time frame, usually within one to three years.

One approach to combining both long-term and short-term strategies is to adopt a hybrid investment approach. This involves acquiring properties with the intention of holding them for the long term while also leveraging short-term profit opportunities when they arise.

When it comes to real estate investments, choosing the right financing strategy is crucial for success. By exploring various financing options and understanding the role of debt and equity, investors can make informed decisions to maximize returns and minimize risks.

Debt financing is a common strategy used by real estate investors to leverage their investments. By borrowing money to purchase properties, investors can increase their buying power and potentially generate higher returns. However, it is essential to carefully consider the terms of the loan, including interest rates, repayment schedules, and potential risks associated with leveraging too much debt.

Equity financing involves raising capital from investors or partners in exchange for ownership stakes in the real estate project. This strategy can provide investors with additional funds without taking on debt, diversify risk, and access expertise from partners.

Advantages and Disadvantages of Short-Term Real Estate Investment Strategies

Designing a Combined Real Estate Investment Strategy

Financing Strategies

Leveraging Debt as a Financing Strategy

Role of Equity Financing in Real Estate Investment Strategies