Embarking on the journey of Retirement account contributions, this initial paragraph aims to engage and inform the readers with a formal and serious tone, delving into the intricacies of financial planning and long-term security.

The subsequent paragraphs will delve deeper into the various aspects of retirement account contributions, shedding light on their importance, types, strategies, and tax implications.

Importance of Retirement Account Contributions

Contributing to retirement accounts is a crucial aspect of financial planning that should not be overlooked. It plays a significant role in securing a stable financial future and ensuring a comfortable retirement.

Benefits of Regular Contributions

- Compound Interest: By contributing regularly to retirement accounts, you can take advantage of compound interest, allowing your savings to grow over time.

- Tax Advantages: Retirement account contributions often come with tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement.

- Financial Stability: Regular contributions to retirement accounts help in building a financial cushion for retirement, ensuring a steady stream of income post-retirement.

- Employer Matching: Some employers offer matching contributions to retirement accounts, effectively doubling your savings without any extra effort on your part.

Impact on Long-Term Financial Security

Contributing to retirement accounts has a profound impact on long-term financial security. It provides a source of income during retirement, reducing the risk of financial instability in old age. By consistently saving for retirement, individuals can better prepare for unexpected expenses and maintain their standard of living even after they stop working.

Types of Retirement Accounts

When planning for retirement, it is essential to consider the different types of retirement accounts available. Each type offers unique features and benefits that can impact your contributions and tax implications.

401(k) Retirement Account

- A 401(k) is an employer-sponsored retirement account where employees can contribute a portion of their pre-tax income towards retirement savings.

- Employers may also match a percentage of the employee’s contributions, helping to grow the retirement fund faster.

- Contributions to a traditional 401(k) are tax-deferred, meaning you do not pay taxes on the money you contribute until you withdraw it during retirement.

- Withdrawals from a 401(k) are taxed as ordinary income.

Individual Retirement Account (IRA)

- An IRA is a retirement account that individuals can set up on their own, independent of their employer.

- There are two main types of IRAs: traditional and Roth.

- Contributions to a traditional IRA may be tax-deductible, reducing your taxable income for the year you make the contribution.

- Withdrawals from a traditional IRA are taxed as ordinary income.

- Roth IRA contributions are made with after-tax dollars, meaning withdrawals in retirement are tax-free.

Comparison and Considerations

When choosing between a 401(k), traditional IRA, or Roth IRA, consider factors such as your current tax bracket, future tax implications, employer contributions, and investment options available within each account.

Strategies for Maximizing Retirement Contributions

Saving for retirement is crucial to ensure financial stability in the future. Here are some strategies to help you maximize your retirement contributions over time.

Employer Matching

Employer matching is a key strategy for maximizing retirement contributions. This is when your employer contributes a certain amount to your retirement account based on the amount you contribute. Take full advantage of this benefit by contributing enough to receive the maximum matching amount offered by your employer. It’s essentially free money towards your retirement savings.

Catching Up on Retirement Contributions

If you find yourself behind schedule on your retirement contributions, there are strategies you can implement to catch up. Consider increasing your contributions gradually over time, especially if you receive a raise or bonus. You can also take advantage of catch-up contributions allowed for individuals aged 50 and older. These additional contributions can help boost your retirement savings significantly in the long run.

Tax Implications of Retirement Account Contributions

Contributing to retirement accounts comes with significant tax benefits for individuals looking to save for their future. By understanding the tax implications of retirement account contributions, individuals can make informed decisions to maximize their savings while minimizing their tax liabilities.

When you contribute to a retirement account, such as a 401(k) or traditional IRA, you are eligible for tax deductions on the amount you contribute. This means that the money you contribute to your retirement account is deducted from your taxable income, reducing the amount of income that is subject to taxation. As a result, you may end up paying less in taxes for the year in which you make the contribution.

Tax Benefits of Retirement Account Contributions

- Contributions to traditional retirement accounts are typically tax-deductible, reducing your taxable income for the year.

- By lowering your taxable income, you may move into a lower tax bracket, further reducing the amount of taxes you owe.

- Over time, the tax-deferred growth of investments within your retirement account can help you accumulate more wealth for retirement.

How Tax Deductions Work for Retirement Contributions

- For example, if you are in the 25% tax bracket and contribute $5,000 to a traditional IRA, you could potentially save $1,250 in taxes for that year.

- These tax savings can add up over the years, especially as your retirement account grows through investment returns.

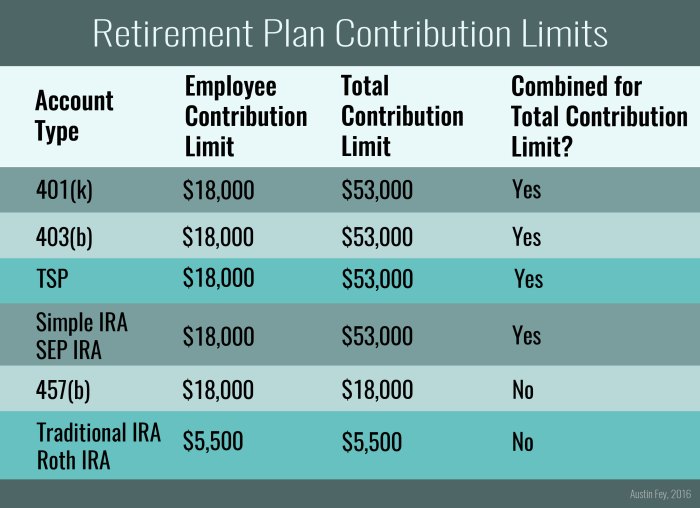

- It’s important to note that tax deductions for retirement contributions have annual limits set by the IRS, so it’s essential to stay informed about the current contribution limits to maximize your tax savings.