Delve into the intricate world of financial investments, where a myriad of opportunities await those seeking to grow and diversify their portfolios. This comprehensive guide sheds light on the different categories of financial investments, offering a nuanced perspective on traditional versus alternative options.

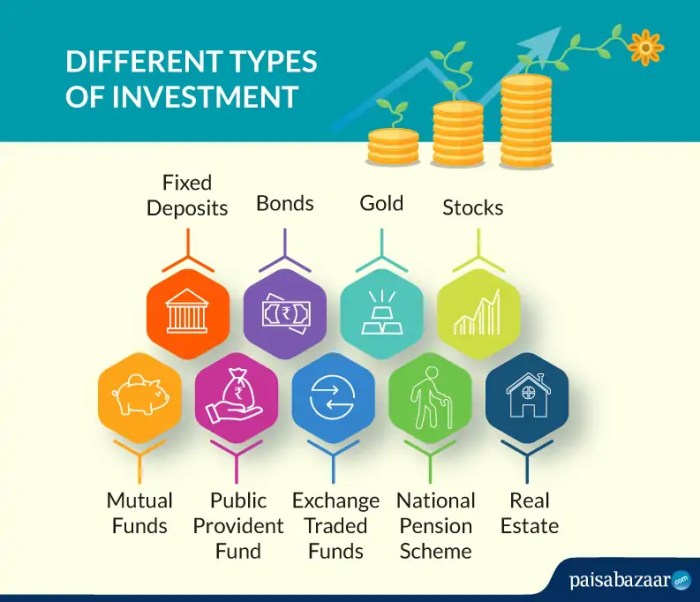

As we navigate through the specifics of equity investments, fixed-income investments, real estate investments, mutual funds, and commodities, a deeper understanding of each asset class emerges, empowering investors to make informed decisions.

Types of Financial Investments

Financial investments refer to assets purchased with the expectation of generating income or profit over time. These investments are made with the goal of increasing wealth and achieving financial goals. There are various categories of financial investments that individuals can consider, each with its own set of risks and potential returns.

Traditional vs Alternative Types of Financial Investments

Traditional financial investments are those that are commonly known and widely used by investors. These may include stocks, bonds, mutual funds, and real estate. On the other hand, alternative investments are less conventional and may include hedge funds, private equity, commodities, and cryptocurrencies.

- Traditional Financial Investments:

- Alternative Financial Investments:

Traditional financial investments are typically more liquid and easier to understand compared to alternative investments. They are regulated by government authorities and are generally considered safer options for investors.

Alternative financial investments are often more complex and may have higher risks associated with them. However, they also have the potential for higher returns compared to traditional investments. Alternative investments are less correlated with the stock market, providing diversification benefits for investors.

Equity Investments

Equity investments refer to the purchase of shares in a company, making the investor a partial owner of that company. This ownership entitles the investor to a share of the company’s profits in the form of dividends and potential capital gains if the stock price increases.

Investing in stocks comes with a set of benefits and risks that investors should carefully consider before entering the market.

Benefits of Investing in Stocks

- Potential for High Returns: Stocks have historically provided higher returns compared to other investment options over the long term.

- Diversification: Investing in a variety of stocks can help spread risk and minimize the impact of losses from any single investment.

- Liquidity: Stocks are typically easy to buy and sell, allowing investors to access their funds relatively quickly.

Risks of Investing in Stocks

- Market Volatility: Stock prices can fluctuate significantly in response to market conditions, economic factors, and company performance.

- Loss of Principal: There is a risk of losing the initial investment if the stock price declines and the investor sells at a loss.

- Company-specific Risks: Investing in individual stocks exposes investors to risks related to the performance and stability of the specific company.

Examples of Popular Equity Investment Options

| Stocks | Exchange-Traded Funds (ETFs) | Mutual Funds |

|---|---|---|

| Shares of individual companies traded on stock exchanges. | Investment funds that hold a basket of stocks and trade on exchanges like individual stocks. | Pooled funds that invest in a diversified portfolio of stocks managed by professionals. |

Fixed-Income Investments

Fixed-income investments refer to financial securities that provide a fixed return to investors over a specific period of time. These investments are considered less risky compared to equity investments, making them a popular choice for investors looking for stable income.

Bonds are a common form of fixed-income investment where investors lend money to a government or corporation in exchange for periodic interest payments and the return of the initial investment at maturity. Bonds have a predetermined interest rate, known as the coupon rate, and a fixed maturity date when the principal amount is repaid to the investor.

Government Bonds vs. Corporate Bonds

Government bonds are issued by the government to finance public spending and are considered one of the safest investments as they are backed by the government’s ability to tax. These bonds typically have lower interest rates compared to corporate bonds but are less risky.

On the other hand, corporate bonds are issued by corporations to raise capital for various purposes, such as expansion or operations. Corporate bonds offer higher interest rates than government bonds to compensate for the increased risk associated with the issuing corporation’s financial health and creditworthiness.

- Government bonds are generally considered lower risk compared to corporate bonds due to the backing of the government.

- Corporate bonds offer higher potential returns but come with a higher risk of default compared to government bonds.

- Investors need to consider their risk tolerance and investment goals when choosing between government and corporate bonds.

Real Estate Investments

Real estate investments involve purchasing properties with the expectation of generating income or profit. These properties can be residential, commercial, or industrial in nature.

Advantages of Real Estate Investments

- Potential for long-term appreciation in property value.

- Steady rental income for property owners.

- Diversification of investment portfolio beyond traditional stocks and bonds.

- Ability to leverage the investment through financing.

Disadvantages of Real Estate Investments

- Illiquidity of real estate assets, making it difficult to sell quickly.

- Ongoing maintenance costs and property management responsibilities.

- Vulnerability to market fluctuations and economic downturns.

- High upfront costs and barriers to entry for first-time investors.

Diversifying a Real Estate Investment Portfolio

To diversify a real estate investment portfolio, investors can consider the following strategies:

- Investing in different types of properties (residential, commercial, industrial).

- Expanding into different geographic locations to reduce risk from local market conditions.

- Considering real estate investment trusts (REITs) or real estate crowdfunding platforms for added diversification.

- Exploring different investment strategies such as fix-and-flip, rental properties, or real estate development projects.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Actively Managed Funds vs. Passively Managed Funds

Actively managed funds are those where the fund manager actively buys and sells securities in an attempt to outperform the market. This approach involves higher fees due to the active management involved. On the other hand, passively managed funds, such as index funds, aim to replicate the performance of a specific market index. These funds have lower fees as they require less active management.

- Actively managed funds rely on the expertise of fund managers to beat the market, while passively managed funds aim to match the performance of the market.

- Actively managed funds tend to have higher turnover rates, leading to higher transaction costs, which can erode returns over time.

- Passively managed funds are more cost-effective and often outperform actively managed funds over the long term due to lower fees.

Benefits of Investing in Mutual Funds for Diversification

Investing in mutual funds allows investors to achieve diversification by spreading their investment across a variety of securities. This helps reduce risk by not putting all eggs in one basket. Other benefits of investing in mutual funds for diversification include:

- Access to a professionally managed portfolio that offers exposure to a wide range of assets.

- Diversification across different sectors, industries, and geographies to minimize concentration risk.

- Ability to invest in a small amount and still have exposure to a diversified portfolio.

- Opportunity to benefit from the expertise of professional fund managers who make informed investment decisions.

Commodities

Commodities are raw materials or agricultural products that can be bought and sold. They are often used as inputs in the production of goods and services, making them essential components of the global economy.

Pros and Cons of Investing in Commodities

Investing in commodities can offer diversification and a hedge against inflation, as their prices are not always correlated with traditional financial assets like stocks and bonds. However, commodity prices can be volatile, and investing in them requires knowledge of the specific market dynamics and factors affecting supply and demand.

- Pros:

- Diversification benefits for a well-rounded investment portfolio

- Protection against inflation due to their tangible nature

- Potential for high returns during periods of increased demand

- Cons:

- Volatility in prices can lead to significant losses

- Requires specialized knowledge and understanding of commodity markets

- Limited income generation compared to other investments

Examples of Popular Commodities for Investment

- Gold: A traditional safe-haven asset that investors turn to during times of economic uncertainty

- Crude Oil: One of the most actively traded commodities in the world, influenced by geopolitical events and global demand

- Corn: An agricultural commodity with a variety of uses, including food production and biofuels

- Silver: Often considered a more affordable alternative to gold for investors looking to hedge against economic risks