Exploring the intricate concept of inflation, this comprehensive guide delves into the various aspects of how inflation impacts economies worldwide. From its definition to its effects, this article provides a detailed overview that will enhance your understanding of this crucial economic phenomenon.

In the following sections, we will explore the types of inflation, factors influencing inflation, and the effects it has on different sectors of the economy. By the end, you will have a thorough grasp of the complexities surrounding inflation.

Definition of Inflation

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. It results in a decrease in the purchasing power of a country’s currency, leading to each unit of currency buying fewer goods and services.

Examples of How Inflation Affects Purchasing Power

- As prices rise, consumers can afford fewer goods with the same amount of money.

- Fixed-income earners, like pensioners, see a decrease in their real income as prices increase.

- Businesses may struggle with higher costs, impacting their profitability and ability to expand.

Causes of Inflation and How it is Measured

Inflation can be caused by various factors, including:

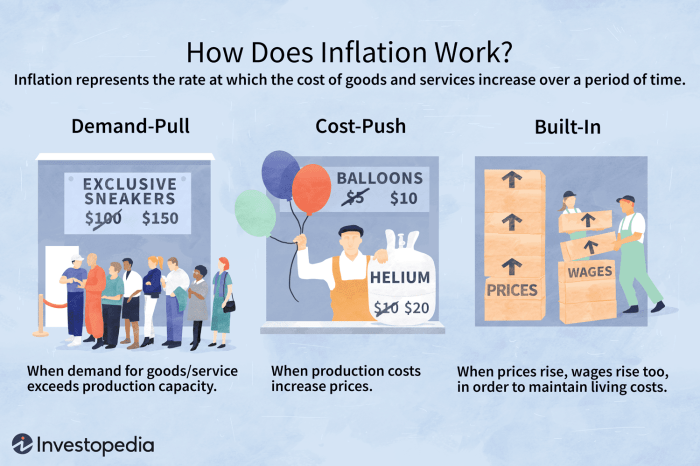

- Demand-Pull Inflation: When demand for goods and services exceeds supply, leading to price increases.

- Cost-Push Inflation: When production costs rise, causing businesses to pass on the expenses to consumers.

- Monetary Inflation: When there is an increase in the money supply without a corresponding increase in goods and services.

Inflation is commonly measured using indices such as the Consumer Price Index (CPI) or the Producer Price Index (PPI), which track changes in the prices of a basket of goods and services over time.

Types of Inflation

Inflation can manifest in various forms, each with distinct causes and effects that impact the economy differently.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services surpasses their supply in the economy, leading to an increase in prices. This type of inflation is often associated with strong economic growth, increased consumer spending, and low unemployment rates. The impact of demand-pull inflation includes a decrease in purchasing power for consumers, reduced savings due to higher prices, and potential overheating of the economy if left unchecked.

Cost-Push Inflation

Cost-push inflation arises from an increase in production costs, such as wages or raw materials, which are then passed on to consumers in the form of higher prices. This type of inflation can be triggered by factors like rising energy prices, supply chain disruptions, or wage hikes. The effects of cost-push inflation can lead to reduced profit margins for businesses, lower real incomes for workers, and a slowdown in economic growth as businesses cut back on production.

Built-In Inflation

Built-in inflation, also known as wage-price inflation, is a self-perpetuating cycle where past inflation influences future inflation through automatic adjustments in wages and prices. This type of inflation is often linked to expectations of rising prices, as workers demand higher wages to keep up with inflation, leading to further price increases. The consequences of built-in inflation include eroding purchasing power, wage-price spirals, and challenges for policymakers in controlling inflation expectations.

Each type of inflation carries its own set of challenges and implications for the economy, requiring a nuanced approach to address the underlying causes and mitigate the negative impacts on consumers, businesses, and overall economic stability.

Factors Influencing Inflation

Inflation is influenced by a variety of factors that interact to determine the overall price level in an economy. Understanding these key factors is crucial for policymakers and economists to effectively manage inflation rates.

Government Policies

Government policies play a significant role in shaping inflation rates. For example, expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate demand in the economy, leading to higher inflation. On the other hand, contractionary monetary policies, like raising interest rates, can help control inflation by reducing spending and investment.

Supply and Demand Dynamics

The interaction between supply and demand is another critical factor affecting inflation. When demand exceeds supply, prices tend to rise, leading to inflation. Conversely, if supply outstrips demand, prices may fall, resulting in deflation. Understanding these dynamics is essential for predicting inflationary pressures in an economy.

External Factors

External factors, such as global economic conditions, exchange rates, and geopolitical events, can also impact inflation rates. For example, a sudden increase in oil prices due to geopolitical tensions can lead to higher production costs for businesses, resulting in inflation. Similarly, fluctuations in exchange rates can affect the prices of imported goods, influencing inflation levels.

Examples of Impact

– Changes in money supply: An increase in the money supply without a corresponding increase in production can lead to excess demand, pushing prices up.

– Production costs: Rising production costs, such as labor or raw material costs, can result in higher prices for goods and services, contributing to inflation.

– Consumer behavior: If consumers expect prices to rise in the future, they may increase their spending now, driving up demand and leading to inflationary pressures.

Effects of Inflation

Inflation can have significant effects on various aspects of the economy, impacting consumers, businesses, and the government. It also plays a crucial role in influencing interest rates, investment decisions, and overall economic stability. Furthermore, inflation can lead to income redistribution and affect savings and investments.

Impact on Consumers

- As prices rise, consumers may experience a decrease in purchasing power, leading to a reduction in their standard of living.

- Fixed-income earners, such as retirees, may struggle to keep up with the increasing cost of goods and services.

- Consumers may also alter their spending habits, prioritizing essential items over discretionary purchases.

Impact on Businesses

- Businesses may face higher production costs, which can reduce profit margins unless they are able to pass on the increased costs to consumers.

- Uncertainty about future price levels can make it challenging for businesses to plan effectively and make long-term investment decisions.

- Inflation can also impact employee wages and benefits, potentially leading to labor disputes.

Impact on Government

- The government may struggle to balance its budget as inflation erodes the real value of tax revenue and increases the cost of servicing debt.

- Inflation can also affect the implementation of fiscal policies aimed at stimulating economic growth or controlling inflation itself.

Impact on Interest Rates and Investment Decisions

- Inflation typically leads to higher interest rates as central banks aim to control inflation by tightening monetary policy.

- Higher interest rates can discourage borrowing and investment, slowing economic growth in the process.

- Investors may seek assets that offer protection against inflation, such as real estate or commodities.

Income Redistribution and Savings/Investments

- Inflation can result in income redistribution, as those with the ability to increase prices benefit at the expense of fixed-income individuals.

- Individuals may seek to protect their savings and investments by investing in assets that provide a hedge against inflation, such as stocks or precious metals.