Hey there, ready to dive into the world of Strategies for paying off debt? Get ready for a rollercoaster ride of tips, tricks, and insights that will help you conquer your financial woes like a boss.

In this guide, we’ll explore the ins and outs of debt repayment plans, budgeting hacks, income-boosting strategies, and when it might be time to call in the professionals. So buckle up, because we’re about to take your financial game to the next level.

Understanding Debt

Debt is money that is borrowed and must be repaid with interest. There are different types of debt, including student loans, credit card debt, mortgages, and personal loans.

Types of Debt

- Student Loans: Money borrowed to pay for education expenses.

- Credit Card Debt: Balance owed on credit cards for purchases made.

- Mortgages: Loans taken out to purchase a home.

- Personal Loans: Borrowed money for various personal expenses.

Impact of Debt on Financial Health

Debt can have a significant impact on financial health, affecting credit scores, ability to save, and overall financial stability. High levels of debt can lead to financial stress and impact future financial goals.

Common Sources of Debt

- Medical Bills: Expenses related to healthcare and medical treatments.

- Auto Loans: Money borrowed to purchase a vehicle.

- Personal Expenses: Day-to-day expenses that may be funded through loans or credit cards.

Creating a Debt Repayment Plan

When it comes to paying off debt, having a solid repayment plan is key to achieving financial freedom. By setting clear goals and prioritizing your debts, you can effectively work towards becoming debt-free. Let’s dive into the essential steps for creating a debt repayment plan.

Setting Clear Financial Goals

- Start by defining your financial goals, whether it’s paying off a specific debt amount, becoming debt-free by a certain date, or improving your credit score.

- Having clear goals will help you stay motivated and focused on your journey towards financial freedom.

- Consider creating short-term and long-term goals to keep track of your progress and celebrate milestones along the way.

Prioritizing Debts for Repayment

- Make a list of all your debts, including outstanding balances, interest rates, and minimum monthly payments.

- Consider prioritizing debts with higher interest rates first to minimize the amount of interest you pay over time.

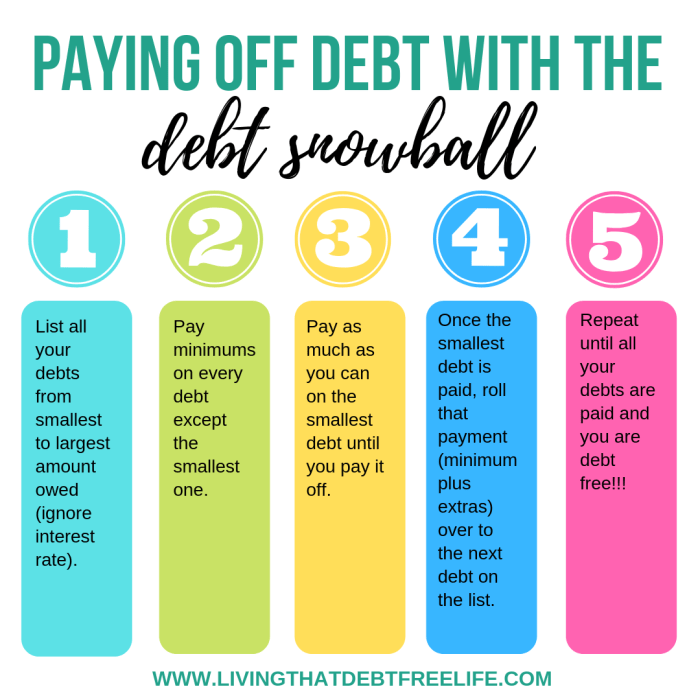

- Alternatively, you can focus on paying off debts with the smallest balances first using the snowball method to gain momentum and motivation.

Different Strategies for Creating a Repayment Plan

- Utilize the snowball method by paying off debts with the smallest balances first and then rolling over the payments to larger debts.

- Consider the avalanche method, which involves paying off debts with the highest interest rates first to save money on interest over time.

- Explore debt consolidation options to combine multiple debts into one lower-interest loan for easier repayment.

Budgeting and Cutting Expenses

Budgeting and cutting expenses are crucial steps in paying off debt and achieving financial freedom. By creating a budget and identifying areas where expenses can be reduced, individuals can free up more money to put towards debt repayment.

Creating a Budget

Creating a budget involves listing all sources of income and expenses to determine how much money is coming in and going out each month. By tracking expenses and identifying areas where spending can be reduced, individuals can allocate more funds towards debt repayment. It is important to prioritize debt payments in the budget to ensure progress towards becoming debt-free.

Cutting Unnecessary Expenses

Cutting unnecessary expenses is key to freeing up more money for debt repayment. This can involve reducing spending on non-essential items such as dining out, subscription services, or impulse purchases. By distinguishing between needs and wants, individuals can make informed decisions about where to cut expenses and increase savings.

Examples of Reducing Spending

- Meal planning and cooking at home instead of eating out

- Cancelling unused subscriptions or services

- Shopping for generic brands instead of name brands

- Using public transportation or carpooling to save on gas

- Comparison shopping for better deals on utilities or insurance

Increasing Income Sources

Increasing your income is a crucial strategy to accelerate the process of paying off debt. By exploring various methods to boost your earnings, you can make significant progress towards becoming debt-free.

Side Hustles and Freelance Work

One effective way to increase your income is by taking on side hustles or freelance work in addition to your regular job. This could involve offering services such as graphic design, writing, tutoring, or driving for rideshare companies. By leveraging your skills and interests, you can generate extra income to put towards your debt repayment.

Diversifying Income Streams

It is essential to diversify your sources of income to create financial stability and resilience. Relying solely on a single income source can leave you vulnerable to financial setbacks. By exploring various avenues such as investments, rental properties, or online businesses, you can build multiple streams of income that can help you pay off debt faster and secure your financial future.

Seeking Professional Help

Seeking advice from financial experts or credit counselors can be beneficial when you feel overwhelmed by your debt and need guidance on how to manage it effectively. These professionals can provide personalized solutions based on your financial situation and help you create a plan to pay off your debts.

Debt Consolidation and Debt Management Programs

- Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, making it easier to manage and pay off.

- Debt management programs work with creditors to negotiate lower interest rates or monthly payments, helping you pay off your debts more efficiently.

- Both options can help simplify your debt repayment process and reduce the overall cost of your debt over time.

Resources for Debt Assistance

- Nonprofit credit counseling agencies offer free or low-cost services to help you create a budget, negotiate with creditors, and develop a debt repayment plan.

- The National Foundation for Credit Counseling (NFCC) provides resources and connects you with certified credit counselors who can offer personalized advice and support.

- Government agencies like the Consumer Financial Protection Bureau (CFPB) offer information on managing debt and avoiding scams, helping you make informed decisions about your financial future.